Be mindful of how much you add to your FHSA. Any contributions exceeding the limits are subject to a tax of 1% per month.

Everything you need to know about the Tax-Free First Home Savings Account (FHSA)

A chance to bring home ownership a little closer

Buying a home can be a challenge for many young Canadians. If you feel that it’s getting harder to get into the housing market, you’re not imagining things. Fluctuations in house and condominium prices and interest rates can play a huge part in a first-time homebuyer’s ability to afford a home. The new Tax-Free First Home Savings Account (FHSA) aims to make this easier by offering Canadians a way to save for a down payment for their first home.

FHSA essentials

* Or until the year you turn age of 71.

** On a qualifying withdrawal; other withdrawals are taxable.

The rules

- Canadian residents aged 18 to 71 who do not own their home currently, and have not owned their own home in the past four calendar years, are eligible to open an FHSA.*

- FHSA contributions count in the calendar year in which they are made, similar to a TFSA. In other words, you need to pay into the account by December 31.

- As with RRSPs and TFSAs, you can carry forward unused contribution room (up to a maximum $8,000 cumulative carry forward) from past years.**

- Only the FHSA holder is permitted to claim deductions for contributions.

- Income and capital gains earned in an FHSA are not taxable and can grow on a tax-free basis.

- Funds from your RRSP can be transferred to an FHSA on a tax-free basis, but you won’t receive a deduction.

- Unused FHSA funds can be transferred to an RRSP or RRIF on a tax-free basis, or withdrawn (but non-qualifying withdrawals are taxable).

* 18 years of age, or the age of majority in your province or territory.

** Contribution room starts to accumulate from the year you open the FHSA.

What’s considered a qualifying withdrawal?

- The qualifying home must be in Canada.

- You must have a written agreement in place to buy or build a qualifying home by October 1 of the year after your withdrawal, and you also must intend to live in the home as your principal residence within a year of buying or building it.

- You must be a resident of Canada from the time of the withdrawal to the acquisition of the qualifying home and a first-time home buyer when you make the withdrawal. There is an exception to allow individuals to make qualifying withdrawals within 30 days of moving into a qualifying home.

Growing your down payment

Despite its name, the FHSA can function as more than a traditional savings account. Instead, think of it as a tax-free investment account. You'll want to take advantage of the potential tax-savings that comes from holding investments that grow in value over time. FHSAs can hold products that go above and beyond your traditional savings account. Consider investments such as mutual funds or ETFs to help maximize the growth and value of your FHSA.

Investments that qualify for an FHSA:

- mutual funds

- exchange-traded funds (ETFs)

- publicly traded securities

- government & corporate bonds

- guaranteed investment certificates (GICs)

The investments you hold in your FHSA might be different than what you would own in an RRSP, and potentially a TFSA. That’s because the FHSA comes with a shorter time horizon: you need to withdraw those funds within 15 years of opening the account, but many people will likely use them sooner. That shorter time horizon and the fact that FHSA funds are meant to be withdrawn all at once means exposure to volatile asset classes can increase the risk of investment losses. Mutual funds and ETFs offer a bundle of individual stocks or bonds in one purchase, and this diversification can make them a less risky investment than buying stock in a single company.

Getting the most out of your FHSA

If you're simply holding cash in a savings account, you may be earning an interest rate around 1%. That's better than nothing, but you have the potential to earn a better return. Due to the power of compound growth, the FHSA has the potential to build up a meaningful down payment over the life of the account, even if you are earning modest returns on your investments.

Closing your FHSA

The FHSA must be closed by December 31 in the year that any of the following conditions are met:

- You turn age 71.

- It is the 15th anniversary of first opening the account, and the funds have not been used to purchase a qualifying home.

- It is the year following the year of the qualifying withdrawal.

What if you don’t use your FHSA savings?

Unused funds in the FHSA can be transferred to an RRSP or RRIF on a tax-free basis before the FHSA closure. Any unused funds not transferred to a RRSP or RRIF would have to be withdrawn on a taxable basis.

Is the FHSA the best way to save for a home?

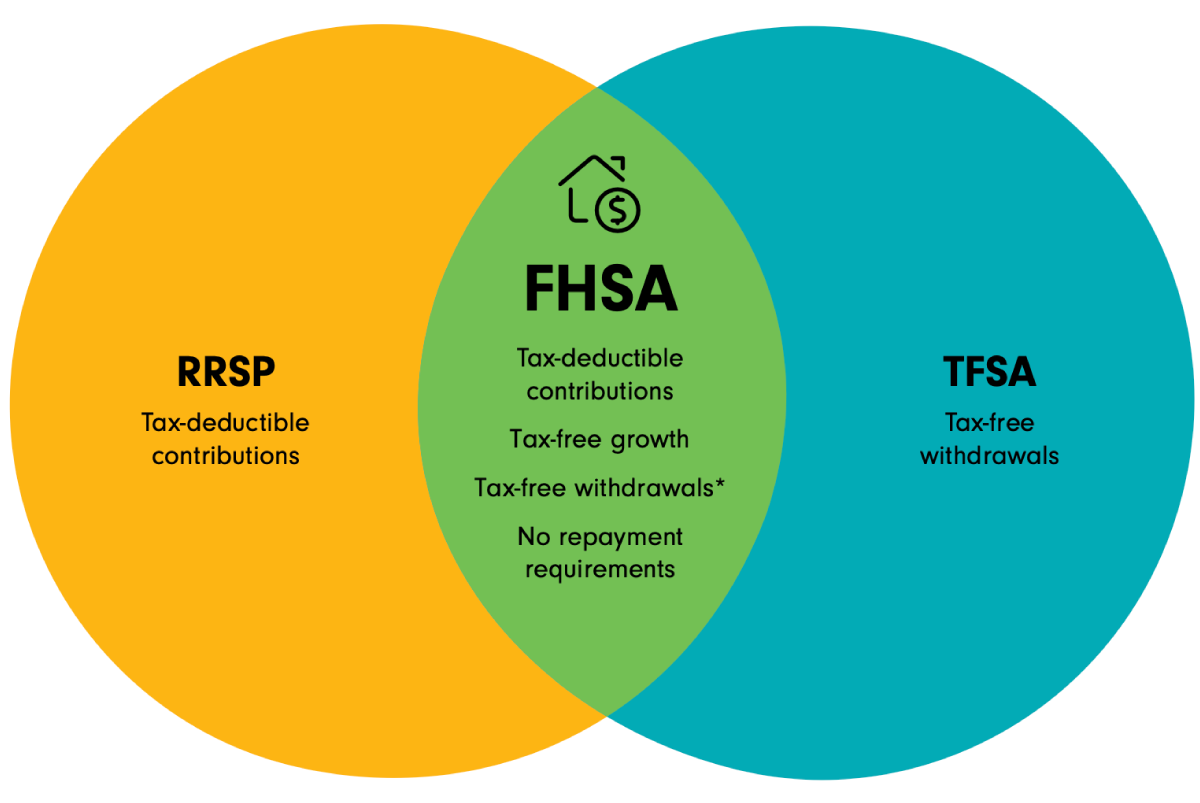

The tax advantages offered by the FHSA can make it the most tax-efficient of all the registered accounts available in Canada, but using the RRSP Home Buyers' Plan and TFSA can also bring advantages. In fact, you might choose to use all three. The route you choose may depend on your personal situation.

| Account | RRSP Home Buyer's Plan | FHSA | TFSA |

|---|---|---|---|

| Contributions | Deductible | Deductible | Not deductible |

| Investment growth | Tax-deferred | Tax-free | Tax-free |

| Withdrawals | Tax-deferred | Tax-free | Tax-free |

There are complexities to all these accounts, and you should always consider what’s best for your own circumstances.