Fidelity Perspectives: Unlocking opportunities in 2025

2024 in review

The year 2024 was marked by a series of events that had a significant impact on global markets. Nearly half the global population hit the polls, with more than 24 elections taking place in countries that included the U.S., India and Mexico. Inflation moderated globally, falling much closer to target rates and allowing central banks to commence policy interest rate reductions. The U.S. Federal Reserve (the Fed) started its cycle with a 50-basis-point (bp) reduction in September. The Bank of Canada was more aggressive in easing, cutting rates by 175 bps over the year, motivated by Canada’s slower economic growth and heighted vulnerability to high interest rates, due to high consumer debt levels and shorter mortgage renewal cycles.

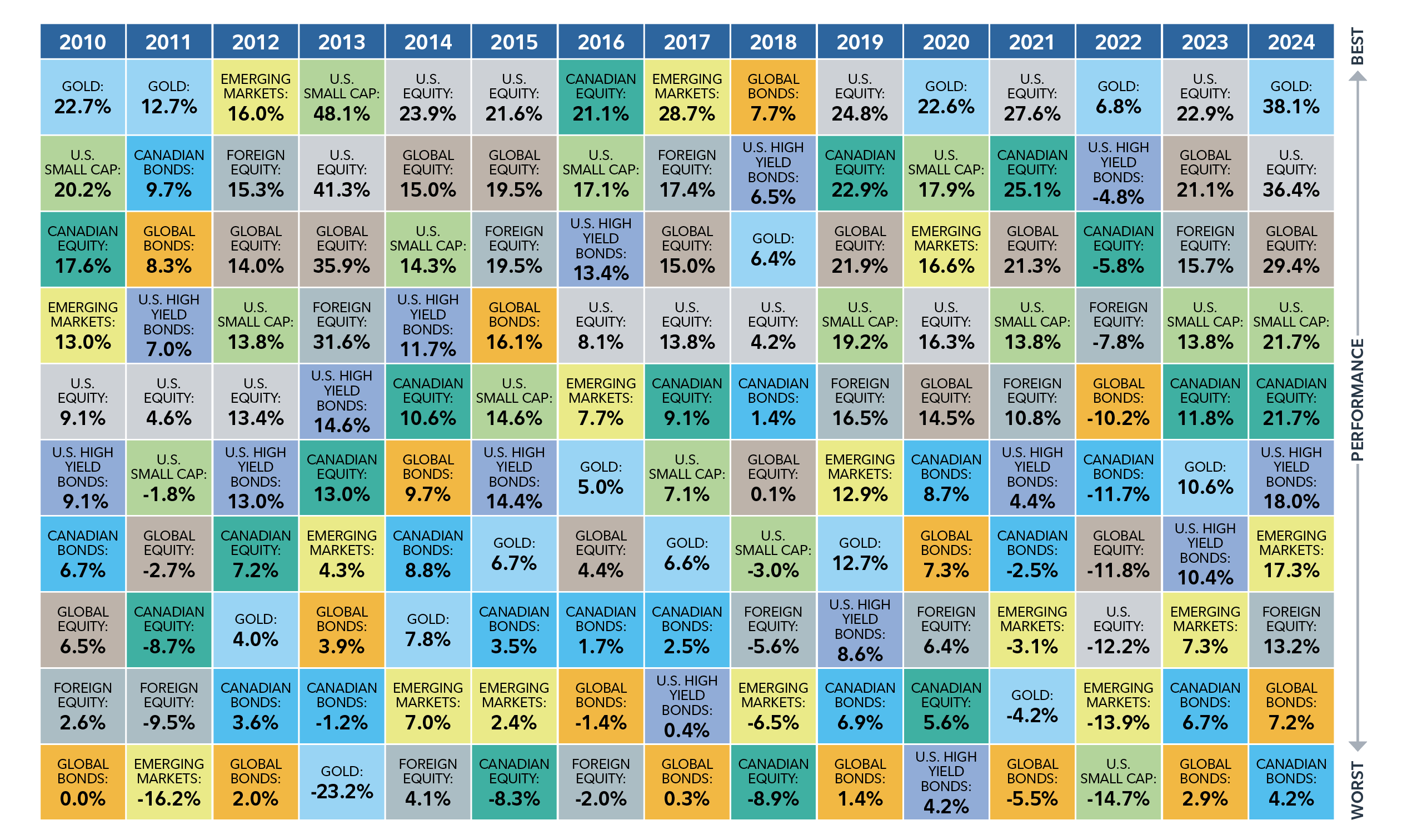

Expectations of lower interest rates caused a shift in market sentiment on fixed income, allowing the asset class to gather nearly $43 billion in Canadian mutual funds and ETF net flows, year-to-date as at November 30, 2024,1 outpacing any other asset class, and gaining almost three times last year’s $16 billion.2 Equity funds in the Canadian investment industry also had a strong year, gathering $38 billion in combined flows, following redemptions, in 2023.3 Equities continued their late-2023 momentum, driven by a resilient economy, the promise of artificial intelligence and the Fed’s long-anticipated pivot to cutting interest rates. Toward the end of the year, expectations that a second Trump presidency will be pro-business further supported markets. For the first time in over two decades, the S&P 500 Index posted a total return above 20% (in U.S. dollars) for a second consecutive year, earning 25.0% in U.S. dollars and 36.4% in Canadian dollars, as shown in chart 1.

From a factor perspective, momentum, growth and quality were the top performers in 2024, while low volatility, value and dividend stocks lagged the broad-based S&P 500 Index – although still producing positive returns. From a market cap perspective, large-cap stocks outperformed small caps over the year. At the sector level, communication services (40.2%), information technology (36.6%), financials (30.5%) and consumer discretionary (30.1%), all outperformed the broad-based S&P 500 Index. The dispersion among sectors – that is, the difference between the top and bottom sectors – was less than 41%, compared with 65% in 2023. This suggests a potential improvement in overall market health, with the previous narrowness of sector performance now easing. Another memorable milestone for 2024 is that it was the year bitcoin reached $100,000, following a halving cycle and anticipations of a more accommodative regulatory stance in the White House.

What is to come in 2025?

After a broad-based rally in 2024, underpinned by easing macroeconomic concerns and strong market sentiment, the attention now shifts to whether these tailwinds can sustain their momentum into 2025. As markets contend with elevated valuations, evolving monetary policy and shifting economic dynamics, the year ahead is poised to bring both challenges and opportunities. Key factors such as the trajectory of interest rates, corporate earnings strength and potential shifts in regional and sectoral leadership will play a pivotal role in shaping the investment landscape. According to our portfolio managers, here are the most critical themes and trends to watch as we head into 2025.

Several Fidelity portfolio managers have weighed in on what investors can expect in 2025.

Andrew Marchese

Chief Investment Officer and Portfolio Manager Andrew Marchese anticipates an investment landscape in 2025 defined by abundant liquidity, evolving market dynamics and the need for disciplined stock selection. The post-COVID era has brought about fundamental shifts in how monetary policy and money supply influence asset prices, with central banks globally shifting toward easing. This backdrop, while it supports risk assets, demands a selective and measured approach to identify meaningful opportunities amid compressed economic cycles and elevated valuations.

Andrew views liquidity as the defining feature of the current market environment. With global money supply at unprecedented levels, liquidity has become a key driver of valuations, fostering a backdrop where asset prices can compete for capital based on relative earnings potential. Despite modest economic growth, corporate profits have shown resilience, aided by productivity gains that are helping companies achieve robust earnings growth even amid broader macroeconomic challenges. This stability in earnings expectations forms a solid foundation for equity markets heading into the new year.

The prospect of lower interest rates is another critical factor shaping the outlook for 2025. Central bank rate cuts are expected to reduce debt servicing costs for both consumers and corporations, potentially reigniting demand and creating favourable conditions for a new credit cycle. This, in turn, could provide a dual tailwind for equities, through both earnings growth and valuation expansion as equity risk premiums decline in a more stable credit environment.

Andrew is focused on identifying opportunities in areas that have yet to fully participate in the market’s recent rally. Consumer discretionary stocks, for example, remain under pressure from negative earnings revisions, but could benefit from cyclical improvements. He also emphasizes the importance of identifying long-term winners in a market increasingly defined by a “winner takes all” dynamic, in which dominant companies with durable competitive advantages are likely to continue outperforming. These opportunities underscore the need for a highly selective, bottom-up investment approach.

The current environment is also marked by increasingly compressed market cycles and rapid price adjustments driven by financial engineering and liquidity flows. Andrew stresses the importance of maintaining discipline and avoiding the pitfalls of speculative trends or over-reacting to short-term volatility. He notes that as breadth in market leadership expands beyond mega-cap growth stocks to a broader set of sectors, stock pickers who focus on idiosyncratic opportunities with strong fundamentals are well positioned to succeed.

While acknowledging risks such as geopolitical uncertainty, inflation and potential disruptions in credit markets, Andrew remains optimistic about the ability of the equity market to deliver strong risk-adjusted returns in 2025. By prioritizing high-conviction investments in companies with durable earnings growth and maintaining a disciplined approach in a complex market, Andrew believes investors can navigate the challenges of 2025 and capitalize on the opportunities presented by this transformative environment.

David Wolf, David Tulk, and Ilan Kolet

Portfolio Managers David Wolf and David Tulk and Institutional Portfolio Manager Ilan Kolet observe that economic activity remains resilient while central banks continue to cut policy interest rates. Canada, however, has shown anemic growth. The managers view Canada as lagging behind a broader productivity tailwind, because Canadian households are likely to continue to struggle, curtailing spending so as to focus on debt repayment. The managers view the U.S. consumer base as a pillar of strength, but they are observing a divergence between U.S. and Canadian consumers, with the U.S. consumer being more resilient.

The managers remain relatively optimistic: the macro outlook is supported by robust productivity-infused economic growth and resilient employment, with recession probabilities remaining low in most major economies. In addition, central banks are no longer tightening monetary policy, and while interest rate cuts may not provide as much support, fiscal spending is expected to provide an additional tailwind for growth. The managers recognize that U.S. market valuations are elevated relative to history; however, they note that they are lifted by the largest companies, and that the median S&P 500 stock is not far above the historical average valuation.

With headline inflation having continued to moderate, the managers believe central banks may not feel the need to maintain as stringent a monetary policy, and that the Fed’s policy rate normalization will continue, providing slightly easier financial conditions into 2025. However, the managers believe that the last mile toward the Fed’s 2% inflation target could remain a challenge. They also suggest that potential trade barriers and fiscal expansion following the U.S. election could fuel a rise in inflation, making the job of central banks more challenging. Accordingly, the managers continue to hold inflation-protection bonds, as well as gold exposure, which was a top-performing asset class in 2024.

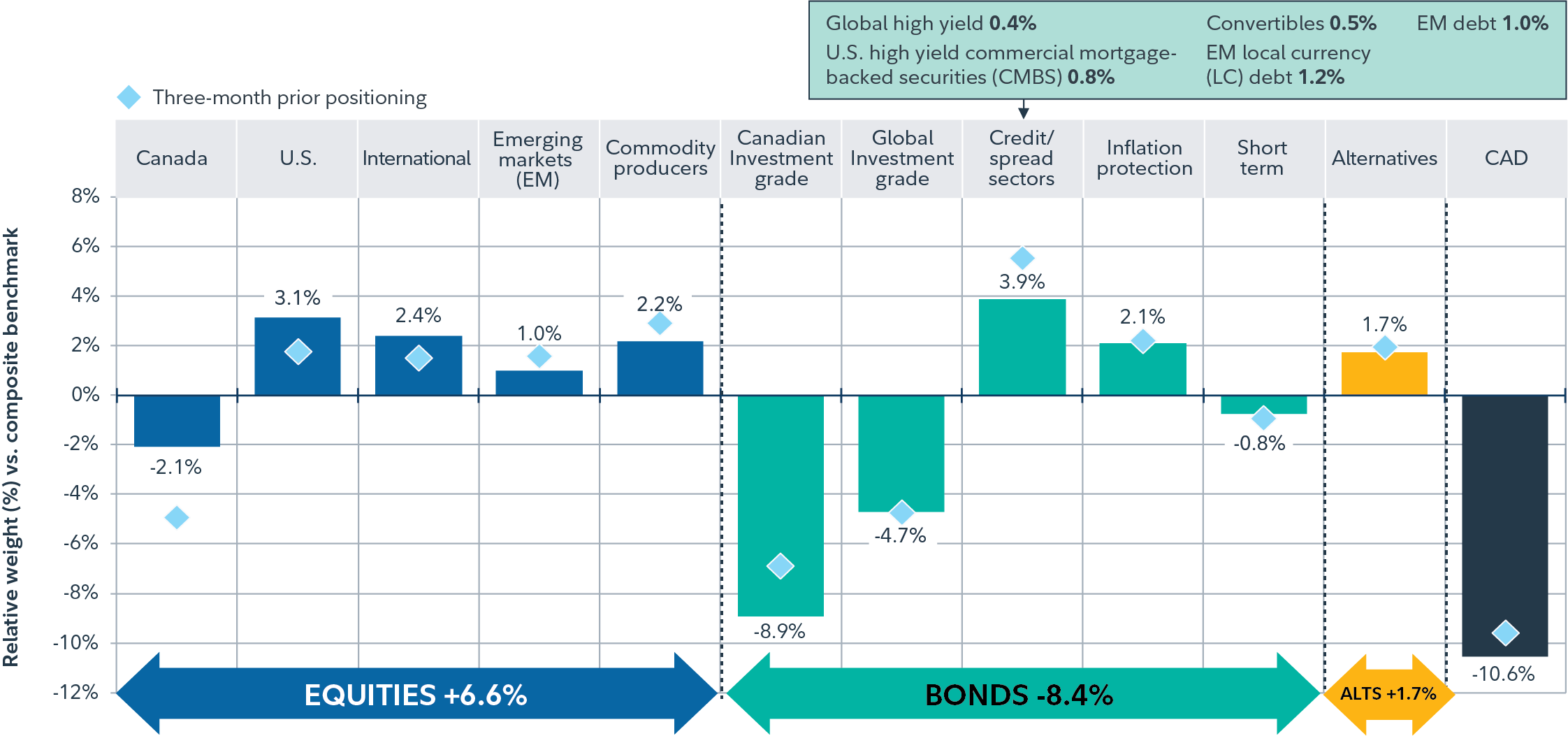

Although interest rates have decreased in the U.S., the managers do not expect them to go as low as market participants expect. They also believe that the risk to longer-term bond yields in the U.S. appears to be to the upside, given term premiums, coupled with the limited scope the Fed has for easing. In these circumstances, they continue to allocate less than the benchmark to fixed income duration in their multi-asset class funds, avoiding long-term bonds and leaning toward shorter maturities and select credit exposures, as shown in chart 2. The managers believe that constructing portfolios that are well diversified across asset classes, styles and regions is the right way to protect and grow capital over the long run.

Viewpoints from our fixed income portfolio managers

Michael Plage, Celso Muñoz, Stacie Ware and Brian Day

Portfolio Managers Michael Plage, Celso Muñoz, Stacie Ware and Brian Day note that the “everything rally” continued for a second year: most major fixed income sectors posted positive returns following the great interest rate reset of 2022. High starting yields provide both a cushion against rising interest rates and a total return tailwind when rates are falling. The managers note that U.S. Treasury securities offer compelling yield and diversification benefits, while many credit sectors are expensive from a valuation perspective, and may be vulnerable to repricing at some point.

How expensive are U.S. investment-grade corporate bonds? As seen in Chart 3, as at December 31, the yield for this sector is 5.33%, which reflects a 4.53% risk-free rate and a credit spread of 0.80%. Since 2009, the average credit spread has been 1.46%, suggesting that today’s levels are much lower than historical averages – and have been wider 99% of the time, making them vulnerable should a reversion to the mean occur. This also suggests that the opportunity cost of being underweight in investment-grade corporate bonds is low, because it is possible to earn a 4.53% yield – with zero credit risk – through an allocation to a U.S. Treasury of similar maturity. That amounts to 85% of the yield earned from owning corporate bonds. The chart also shows that spreads for other credit sectors such as high yield and emerging markets debt are historically tight as well.

.png)

Nobody can say for certain when spreads could be repriced, and the reality is that they can remain tight for a prolonged period of time; accordingly, the managers emphasize the importance of being disciplined and

patient. Potential changes in U.S. trade policies and other geopolitical risks around the world make the managers cautious about the credit markets.

Against this background, the managers’ combined allocation to U.S. Treasuries and cash in all five of their multi-sector fixed income strategies is the highest it has ever been. For example, Fidelity Multi-Sector Bond Fund owns a combined 64% allocation to U.S. Treasuries and cash, compared with only 16% in April 2020, when spreads were wider. Today, given tight spreads, the managers believe they are not being compensated enough for taking on incremental risk. Looking forward, the managers remain confident that a flexible multi-sector approach to fixed income will provide investors with valuable yield, diversification and liquidity benefits in a balanced portfolio.

Adam Kramer

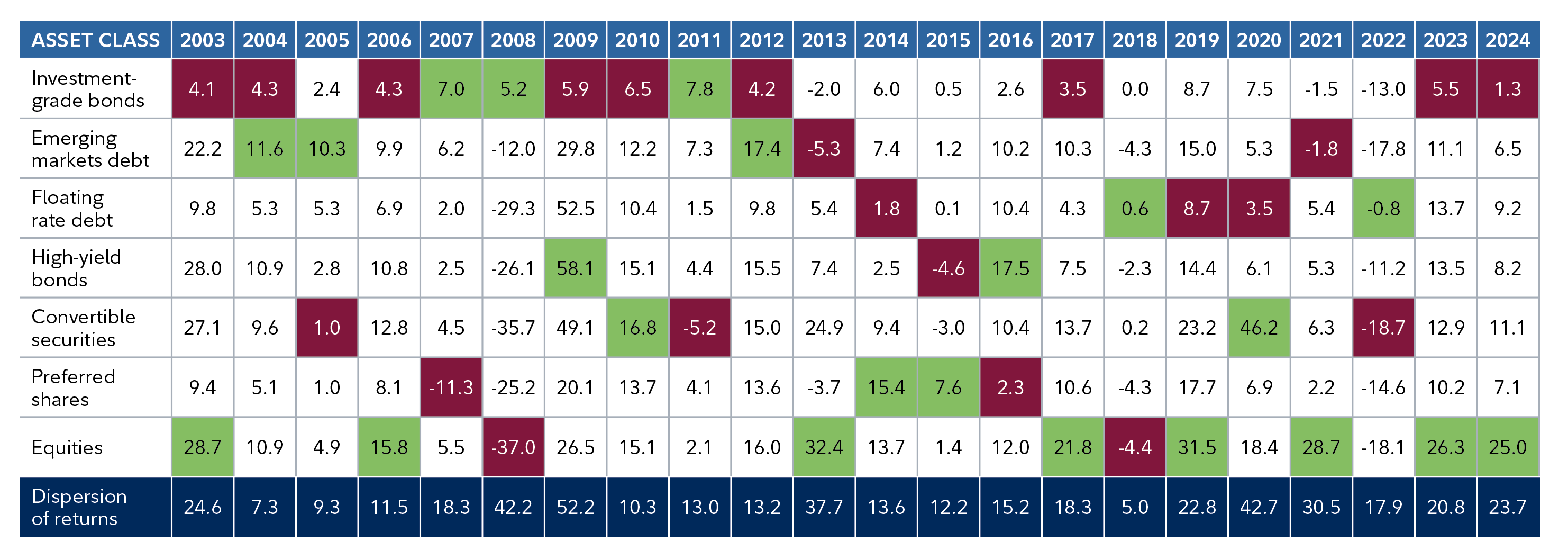

Adam Kramer, Portfolio Manager of Fidelity Tactical High Income Fund, stands ready to adapt the portfolio as we head into 2025, positioning it to capitalize on potential opportunities arising from shifts in macroeconomic and market conditions. As shown in Chart 4, asset class leadership tends to change from year to year; this highlights the importance of tactically allocating across an entire spectrum of income-oriented asset classes.

Adam’s goal is to uncover opportunities within these asset classes that have the potential to deliver equity-like returns during favourable market conditions, coupled with reduced volatility and enhanced capital preservation.

Adam believes that convertibles are beginning to offer real value. They not only offer attractive yields, but also enjoy future potential gains in the stock market that many investors are expecting in the next few years if deregulation and tax cuts help boost U.S. stock prices. Supply-and-demand dynamics in the convertible market are also creating opportunities. Unlike other assets, previously issued convertible bonds are continually “leaving the market” as they convert to stocks while new issues with different features take their places.

In equities, Adam continues to focus on oil tanker companies and Canadian stocks. In Adam’s view, oil tankers continue to provide an attractive dividend yield and may serve as a geopolitical hedge. Canadian equities in sectors such as utilities, financials, industrials and energy also appear attractive; many of these stocks have strong balance sheets and offer appealing dividends, while also trading at a discount to U.S equities.

Collateralized loan obligations (CLOs), high-yield bonds and bank loans will continue to be valuable instruments in the portfolio for generating income with relatively low duration risk. Adam remains focused on identifying opportunities within these asset classes in 2025, aiming to achieve an optimal balance between income generation and risk.

Viewpoints from our equity portfolio managers

Global equities - Mark Schmehl

Against a market backdrop that is continually evolving, Portfolio Manager Mark Schmehl emphasizes the importance of looking beyond the next year or two and concentrating on a longer-term view. Markets are forward-looking mechanisms; therefore, he is focusing on what companies and economies could look like over the medium to longer term. Mark is constructive on markets; and in his view, 2025 could bring many opportunities for active stock pickers. While geopolitical developments may dominate headlines over the next year, the manager emphasizes that market participants should remain focused instead on the trajectory of the U.S. economy. Mark notes that a soft landing in the U.S. in 2025 is now more probable, given the continued resilience displayed by the economy, characterized by a strong consumer base, solid private sector balance sheets and a labour market that has softened but is historically strong.

Mark believes that many of the powerful applications of artificial intelligence (AI) will come to fruition in the new year, transforming the way businesses operate and enhancing efficiency and productivity across the economy. This is a theme that Mark continues to explore actively, with the aim of identifying companies with durable and secular growth tailwinds. In this space, Mark has been focusing on uncovering winners, or transformative companies, that will develop applications to drive AI demand more broadly, particularly software companies that can integrate AI to enhance existing services and create new business models. One such company is Shopify, a top ten position in Fidelity Global Innovators® Class as at September 30, 2024. Mark believes it has the potential to be at the forefront of AI application development, having the ability to leverage in-house capabilities to drive revenue growth and cost efficiencies through the integration of AI. Overall, Mark believes that Shopify’s advancements in the integration of AI tools can support pricing power and customer retention, and be a key driver of earnings growth, positioning the firm as a leader in the e-commerce industry.

Mark also notes there are ample growth opportunities to be found outside of the information technology sector. One area where Mark has been finding ideas is health care, which he believes acts as a strong diversifier to the portfolio. In this sector, Mark is focusing on names that he believes have a good product pipeline, strong pricing power and attractive revenue growth prospects, particularly among pharmaceutical and life sciences names. Finally, in consumer discretionary, Mark has been finding opportunities among homebuilders, which he views as secular growers. While this industry is typically viewed as being cyclical, Mark believes there is a persistent undersupply of housing that should keep demand strong for new construction as homebuilders strive to close the supply gap.

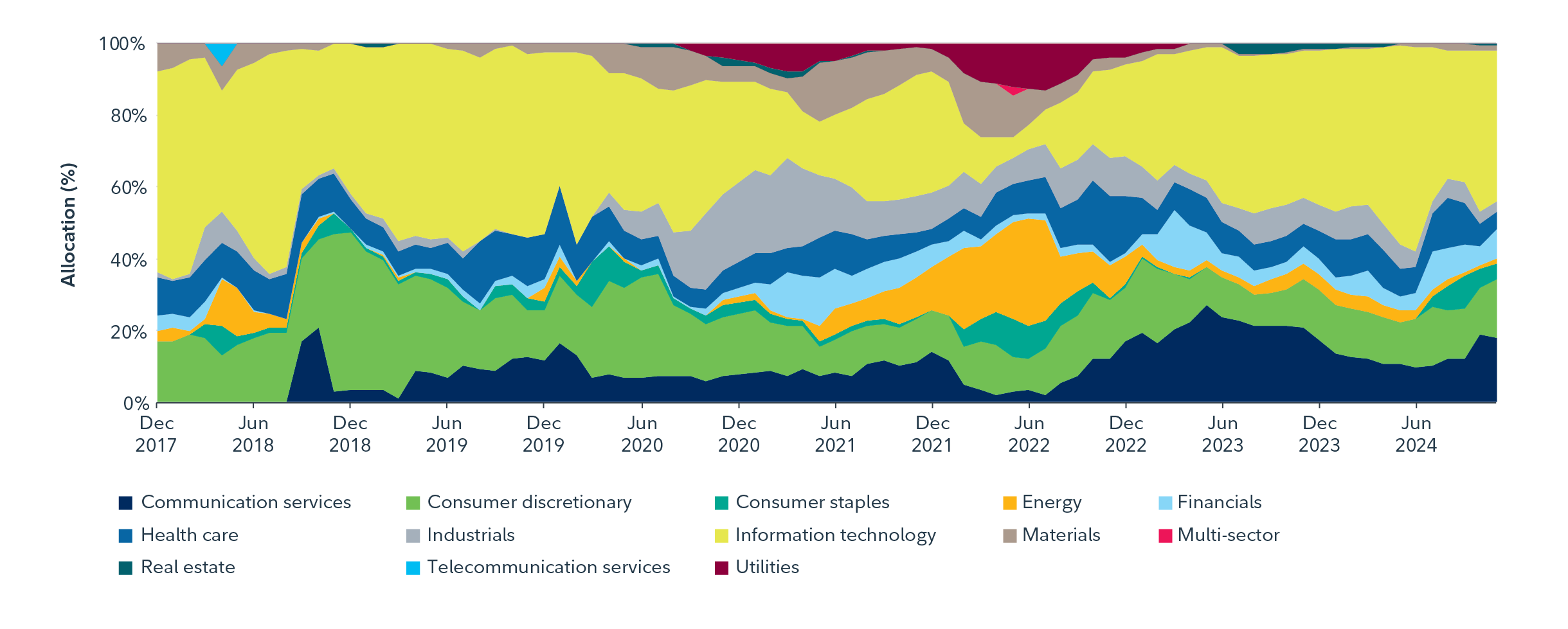

For 2025, Mark reiterates the focus of his investment strategy: finding positive change. In conjunction with the flexible nature of his funds, this has historically enabled him to take advantage of opportunities as they arise, as shown in chart 5.

Sam Polyak

Sam Polyak, Portfolio Manager of Fidelity Emerging Markets Fund, anticipates a transformative period ahead for emerging markets, driven by shifting macroeconomic dynamics and structural tailwinds. The potential for a weakening U.S. dollar stands out as a pivotal factor. A more competitive dollar, coupled with a less aggressive Fed, could reduce the need for emerging market economies to maintain high interest rates, paving the way for domestic consumption to rebound and supporting broader economic growth.

China’s evolving approach to economic stimulus is expected to be a key catalyst. While stimulus measures have been modest thus far, Sam believes more will come as the government prioritizes stability and domestic consumption. This shift could unlock pent-up demand and provide significant momentum for growth. Meanwhile, the ongoing development of innovative companies in China offers further upside, particularly in industries such as technology and electric vehicles.

Elsewhere, regions such as Latin America and Eastern Europe present compelling opportunities. Sam highlights Mexico as a market poised for recovery, supported by improving political conditions and robust economic fundamentals. Eastern Europe, particularly countries such as Greece and Hungary, are benefiting from structural reforms and pro-business policies, creating an attractive backdrop for investors. These regions could gain momentum as global capital flows seek undervalued assets outside of developed markets.

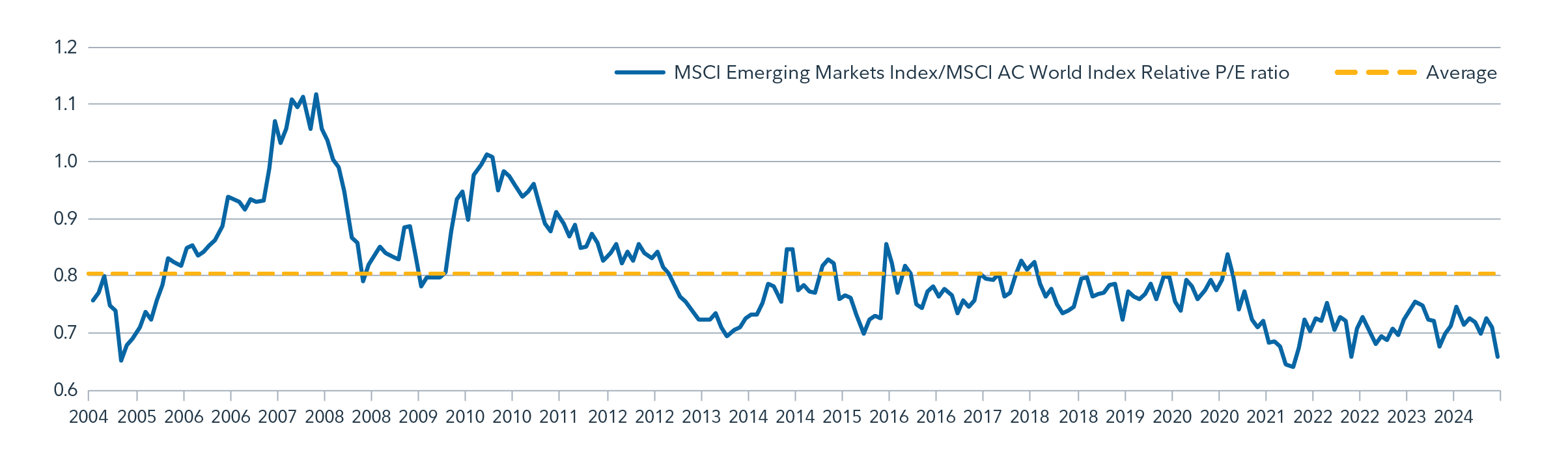

Valuations in emerging markets remain a significant draw, with many high-quality companies trading at discounts relative to their developed market counterparts (see Chart 6). Sam views this as an opportunity for investors to gain exposure to growth at attractive entry points. Additionally, as geopolitical tensions and inflationary pressures ease, he expects improving sentiment to drive a rerating of these undervalued markets.

Looking into 2025 and beyond, the broader themes of digital adoption, urbanization and demographic growth will likely continue to shape the emerging market investment landscape. Sam believes these trends will underpin long-term growth, with innovative companies leading the charge across various sectors. In contrast to developed markets, where growth has been concentrated in a few key areas, emerging markets offer a broader and more diversified set of opportunities.

As the macroeconomic environment evolves, Sam is optimistic that emerging market economies are positioned to capitalize on a more favourable backdrop. With the potential for improving fundamentals, renewed growth and attractive valuations, he sees a strong case for emerging markets to deliver competitive returns in the years ahead.

Salim Hart

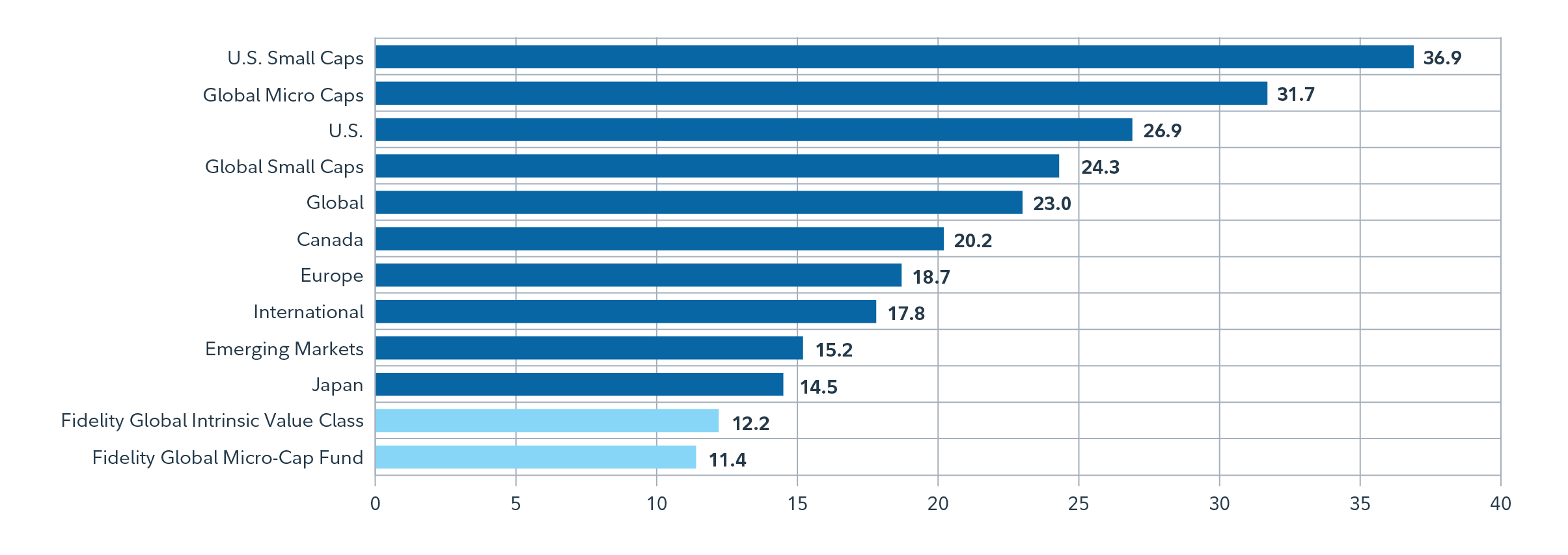

As investors navigate the global policy implications of a new U.S. administration, Fidelity Global Micro-Cap Fund Portfolio Manager Salim Hart anticipates that geopolitical tensions and trade flow disruptions will drive notable valuation dispersions across industries and geographies, as shown in chart 7. While potential challenges may arise in the new year, micro- and small-cap companies typically have a stronger domestic focus, shielding them from the effects of any tariffs or trade wars that may take place in 2025. He is optimistic about the possibility of a cyclical low for small caps, noting a pipeline of smaller companies owned by private equity and venture capital firms that are primed to go public. Additionally, Salim emphasizes the importance of mergers and acquisitions, a key feature of Fidelity Global Micro-Cap Fund, which has seen nine successful buyouts since its inception in May of 2024.

Reflecting on the risk of a potential economic slowdown and inflation resurging following the U.S. presidential election, Salim has positioned the Fund with a balanced investment strategy, combining a mix of defensive securities and economically sensitive cyclical sectors. On the economically sensitive side, the portfolio allocates more than the benchmark to low-beta industrials in Japan, where investor sentiment remains pessimistic, and more than the benchmark to consumer discretionary names, such as home improvement and renovation companies. He balances those positions with staple businesses that tend to benefit from a slower growing economy, such as frozen food distributors and grocers.

There are extensive micro-cap opportunities globally, but they are more abundant in markets outside the U.S. In France, for instance, many companies with a good long-term track record faced substantial turbulence as French elections approached, offering Salim a number of strategically timed, discounted entry points to acquire potentially strong compounders. Elsewhere, the introduction of significant stimulus packages in Asia has provided support for larger-than-benchmark allocations to Japan, China and Hong Kong, in the expectation that corporate governance will improve, offering a superior growth opportunity.

As the micro-cap space remains largely overlooked, Salim aims to capitalize on alpha-rich, high-quality and cheap companies that can potentially generate greater returns. Fidelity Global Micro-Cap Fund may complement investors’ portfolios by providing a differentiated source of growth potential over the long run using active management to exploit the wide dispersion of returns.

U.S. equities - Will Danoff

U.S. equity markets extended their strong performance in 2024. Will Danoff’s focus on “best of breed” companies has driven Fidelity Insights Class to outperform it’s benchmark, capitalizing on a favourable market environment.

After early summer volatility in 2024, clarity on monetary policy and a Republican government has stabilized markets, with strong economic growth and sustained corporate earnings underpinning the rally. Overall, strong performance in equity markets, despite elevated yields, further highlights the durability of this year’s market advance. Continued economic resilience over the past few years has supported a broadening market backdrop and built a solid foundation for continued strength in 2025. Highlighting the theme that strength begets further strength in equity markets, the S&P 500 notched its 55th closing record of the year, powered primarily by investments in technological innovation and a broad preference for U.S. assets.

Will notes considerable expansion of market valuations into the new year, but maintains optimism regarding his Fund’s positioning, and continues to see strong potential for earnings expansion. Easing monetary policy, along with the potential for policies favouring corporate tax cuts, deregulation and industrial growth, can be expected to provide tailwinds for U.S. risk assets in 2025. Given the recent backdrop, Will says he is redoubling his focus on small- and mid-cap stocks with high potential to be future market leaders. Will aims to position the Class in areas of strength, and he notes that 2025 may provide more opportunities to diversify the Class’ active positioning among smaller-cap names.

While large-cap growth names remain a cornerstone of the portfolio, Will sees smaller-cap companies beginning to offer attractive valuations and the potential to grow into new best-of-breed companies. Will remains positive on the earnings environment and has leveraged periods of market volatility to increase concentration in his higher-conviction names. Will believes well-managed companies that can grow their earnings and market shares will thrive, and with the support of Fidelity’s research department, he is confident he can continue to identify new long-term market winners and invest in them opportunistically. He continues to believe the portfolio is well positioned in companies with improving fundamentals that are well positioned as market leaders and that can benefit in an environment supported by secular tailwinds.

Steve Dufour

Portfolio Manager Steve Dufour notes that large-cap growth areas of the market have generally led the market advance, and he expects that strength will continue. However, more recently the equity market appears to promise a resurgence in market breadth in the new year as equity markets anticipate an easing monetary backdrop and new policy measures supported by the incoming Republican government. Steve believes the broadening of sector participation and leading companies indicates a stabilization of the U.S. economy, and a that it is good signal of ongoing strength in corporate earnings.

His portfolio has benefited from the continued strength of the recent market advance. However, earnings estimates and valuations for U.S. equities leading into 2025 have been shaped by high earnings growth projections, setting a high bar when searching for relative earnings growth. Going into the new year, Steve thinks this environment may allow a more selective approach, prioritizing companies with the most compelling earnings growth potential. He also notes the importance market participants will place on the Fed’s rate decisions: these will be a key driver as markets evaluate the new administration’s policies and their impact on different sectors. Early signs of sector strength at the close of 2024 suggest opportunities for careful positioning, with a focus on identifying durable corporate profits and emerging areas of leadership. For the new year, Steve not only expects that artificial intelligence will remain a dominant theme but that it will also be necessary to explore how corporations can learn how to integrate AI technologies in diverse fields to enhance efficiency and competitiveness.

Steve has grown increasingly optimistic about the current state of U.S. equities, but he does note a considerable expansion of valuations going into the new year. Still, expanding corporate earnings growth, along with strong economic activity, continue to bolster the case for U.S. equities. Steve’s process remains focused on an expanding list of investable growth trends such as artificial intelligence and the energy transition. The broadening of current market strength to include a wider range of participating sectors highlights the durability of the current market advance as he continues to focus on individual companies that are achieving relative earnings growth. With the support of the Fidelity research department, he is confident that he can continue to identify long-term market winners. On that basis, he believes the portfolio is well positioned in companies with leading fundamentals that are poised as market leaders and that could bolster the longer-term thesis for Fidelity U.S. Focused Stock Fund’s outperformance.

Canadian equities - Hugo Lavallée

As a fundamental bottom-up stock picker, Hugo Lavallée, Portfolio Manager of Fidelity Greater Canada Fund, embraces the market volatility sparked by uncertainties following the U.S. elections, strategically aligning his portfolios to capitalize on price dislocations. As a contrarian who invests against prevailing market trends, Hugo is exploring segments of the market that are excessively feared by investors, provide limited visibility and are characterized by low expectations. Despite stretched market valuations, he is identifying select cyclical ideas that, from his perspective, are overlooked due to temporary earnings weakness, but are poised to benefit from a robust economy.

When momentum slows, Hugo anticipates that his contrarian style could shine over time by focusing on forgotten names that may be trading at cheap valuations due to their economically sensitive aspect. With the Canadian economy facing pressure from a weak currency and a higher unemployment rate, he sees greater opportunities in U.S. consumer and North American logistics companies, where cyclical dynamics appear to be recovering faster than in the broader market. While 2024 was marked by slower economic growth, the U.S. economy proved resilient, with consumer sentiment improving and showing signs of recovery toward the end of the year, supported by monetary easing and a softening inflation trend. Although Hugo’s portfolios typically have limited exposure to the financials sector, he has been uncovering high-quality Canadian banks and private equity firms with strong fundamentals and appealing valuations that have recently demonstrated impressive results.

Looking ahead, Hugo believes that volatility creates the perfect environment for active management to uncover hidden value with strong long-term growth potential. His unique nature of contrarian investing seeks to provide investors with a differentiated source of alpha over time.

Dan Dupont

Portfolio Manager Dan Dupont expects 2025 to be a pivotal year, with markets contending with historically high valuations, shifting global capital flows and evolving macroeconomic conditions. He believes the U.S. equity market, in particular, could face several headwinds. Credit spreads remain at their tightest levels in nearly three decades, price-to-book ratios for the S&P 500 are at record highs, and growth stocks are trading at their most expensive valuations relative to median levels since 2000.

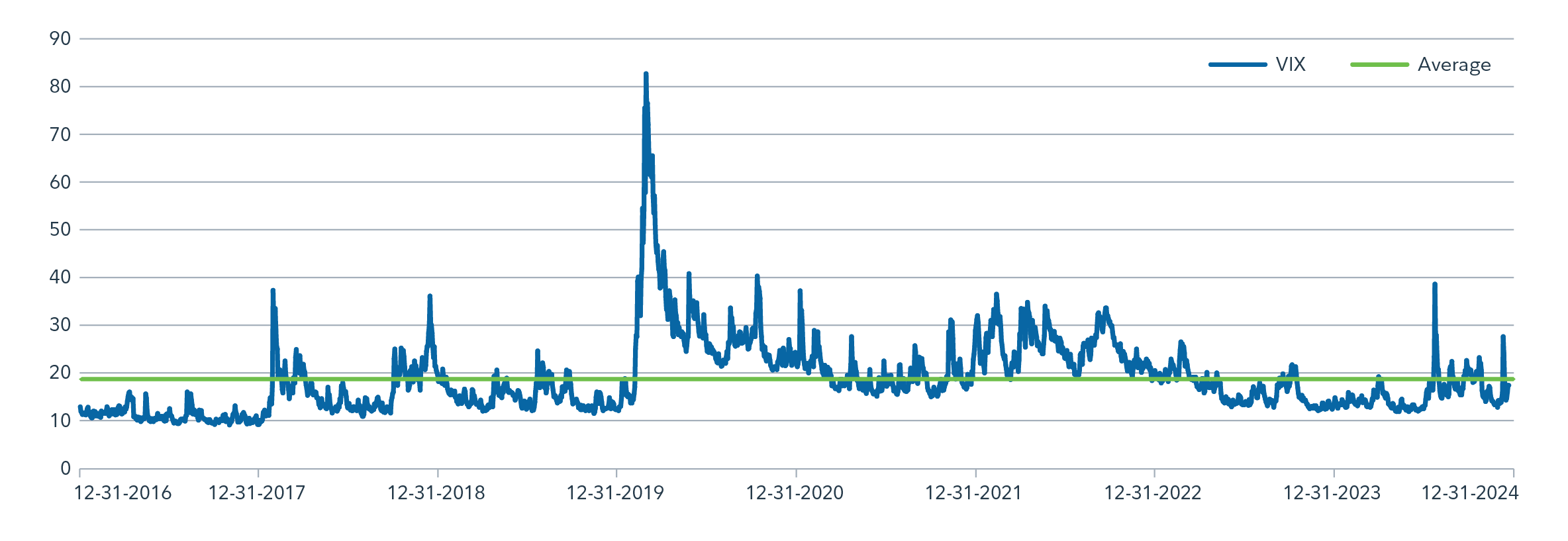

Dan anticipates that these factors, combined with a market that has rewarded momentum strategies over fundamentals, will result in limited upside for U.S. equities in the coming year. Volatility measures such as the VIX Index are near multi-year lows that indicate complacency (refer to Chart 8), but Dan views this as a potential risk factor rather than a sign of stability. He expects U.S. equity performance in 2025 to reflect these elevated risks, particularly in the frothiest parts of the market.

In contrast, Dan sees compelling opportunities in Europe and emerging markets, which are trading at significant discounts relative to the U.S. Dan expects these markets to benefit from structural tailwinds, including technological adoption, demographic growth and improving governance in some regions. He also anticipates that the lack of a global recession, combined with the potential for a weakening U.S. dollar, could serve as a tailwind for these undervalued markets, attracting capital flows and supporting earnings growth.

In Canada, Dan expects continued challenges tied to highly leveraged consumers, as well as a stretched housing market that remains a key source of risk for Canadian banks. However, he sees defensive sectors such as telecommunication services, utilities and consumer staples as well-positioned to provide stability and consistent returns in a year when global economic growth may moderate.

Looking ahead, Dan plans to remain focused on high-quality companies with strong fundamentals, emphasizing sectors and regions where valuations offer a margin of safety. He expects the portfolio to benefit from disciplined bottom-up stock selection, with an eye to undervalued opportunities in regions such as Europe and emerging markets. Dan also stresses the importance of maintaining flexibility to adjust exposures as market conditions evolve.

Dan remains optimistic about the portfolio’s ability to navigate the challenges in 2025 and to capitalize on areas of relative value. Balancing caution with a focus on opportunities in undervalued markets and defensive sectors, he believes the portfolio is well positioned to deliver strong risk-adjusted returns in the year ahead.

Darren Lekkerkerker

Darren Lekkerkerker, Portfolio Manager of Fidelity North American Equity Class, is optimistic about the investment environment heading into 2025. He points to key macroeconomic tailwinds, including the normalization of inflation, global monetary easing and broad-based resilience in corporate earnings, as indicating a supportive backdrop for equities. Darren believes North America offers particularly strong investment prospects, due to its robust innovation pipeline, favourable demographics, lower geopolitical risk and resource self-sufficiency.

While recognizing the high valuation levels of major indicies, Darren sees this as an opportunity for disciplined stock pickers to outperform. He expects 2025 to be a strong year for high-quality companies with the ability to consistently grow free cash-flow per share, supported by favourable economic conditions and structural tailwinds across key sectors.

Darren has identified opportunities in industrials, financials, information technology, communications services and consumer discretionary sectors. In financials, alternative asset management companies are attractive due to the growth in private assets under management and a favourable environment for capital raising and deployment. In industrials, aerospace stands out, benefiting from increasing global air travel demand, constrained new aircraft supply and the rising need for after-market maintenance services. In information technology and communications services, he anticipates significant gains for large technology companies driven by future AI applications, sustained demand growth and enhanced operational efficiencies.

Darren’s outlook reflects a disciplined, fundamentals-driven approach focused on identifying companies that can navigate current challenges while capitalizing on structural growth opportunities. He remains confident that the portfolio is well positioned to deliver strong risk-adjusted returns in the year ahead.

Bitcoin - Reetu Kumra

Reetu Kumra, Portfolio Manager of Fidelity Advantage Bitcoin ETF, remains positive on bitcoin’s medium-term prospects, highlighting the evolving dynamics in the digital asset ecosystem. Over the past year, bitcoin has benefited from several tailwinds, including the halving event scheduled for 2024, increased institutional interest following the approval of several spot ETFs in the U.S. and growing discourse around de-dollarization. These trends collectively signal enhanced political and financial legitimacy for bitcoin, and underscore its emerging status as a store of value.

However, Reetu emphasizes the importance of managing expectations, noting that bitcoin’s evolution is ongoing. Despite a decoupling from traditional risk assets such as the S&P 500 – marking its transition into a distinct asset class – bitcoin continues to exhibit volatility, particularly during periods of risk aversion. This was evident during the pandemic and early 2022. In her view, this volatility is a feature of the asset class and an inherent part of its early stages, not a flaw.

Looking ahead, the innovation within bitcoin’s ecosystem is another promising development. Reetu sees potential in initiatives aimed at scaling bitcoin’s use as a payment method and enhancing its functionality. Developers are actively exploring ways to build a robust innovation layer, a trend she expects to accelerate as bitcoin matures.

From a portfolio perspective, Reetu advocates maintaining a disciplined approach. She believes bitcoin can serve as a strategic diversification tool: a modest allocation (e.g., a 1–3% slice of a portfolio) could offer the potential to enhance risk-adjusted returns over the long term. For investors, the focus should remain on the medium-term thesis, balancing bitcoin’s potential for growth with its inherent volatility.

Heading into 2025, Reetu is optimistic about the supportive factors driving positive sentiment on bitcoin. Concerns about fiscal discipline, the possibility that bitcoin might be used as a strategic reserve asset, and potential deregulation under a new U.S. leadership are expected to bolster its demand. While these developments present significant opportunities, maintaining a measured perspective on bitcoin’s role in portfolios is crucial as its ecosystem continues to evolve.

Fidelity All-In-One ETF Suite - Étienne Bouchard

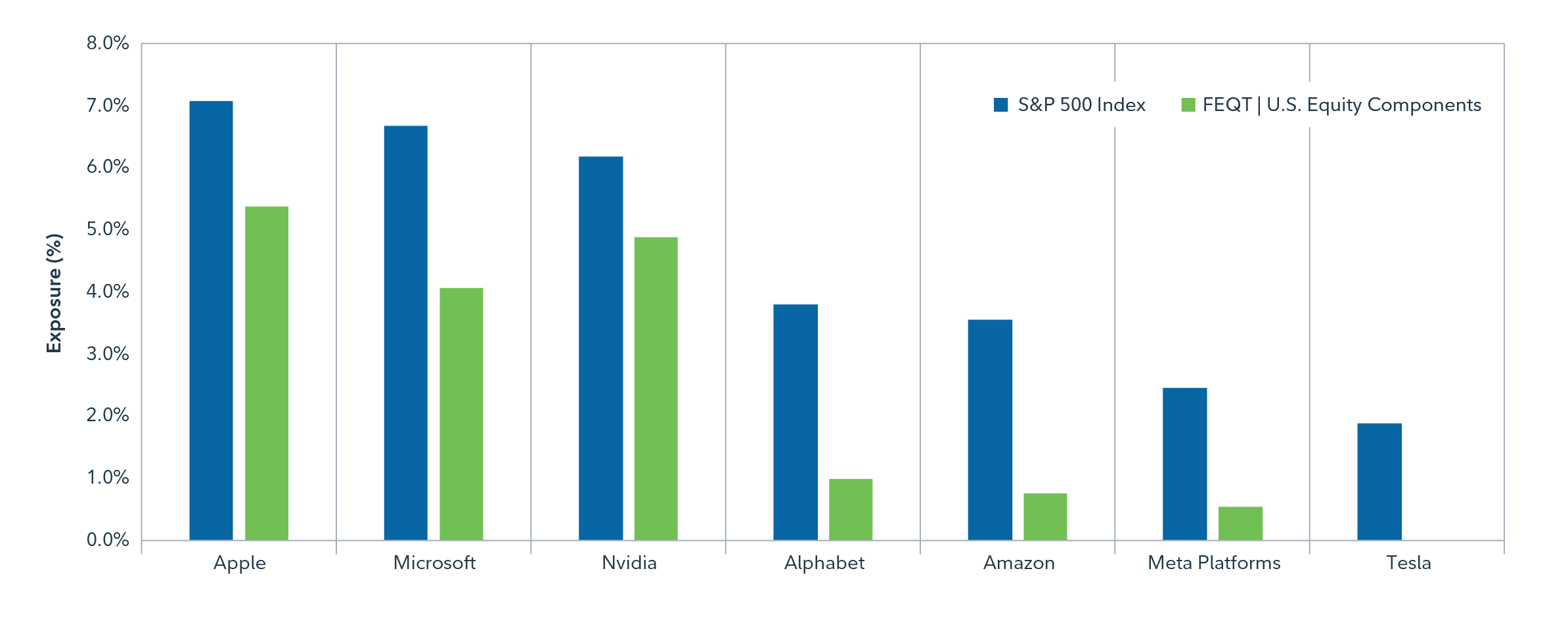

Director of ETF and Alternatives Strategy Étienne Bouchard is excited about the potential on the equity side of the All- in-One suite. Étienne believes the core equity components (the Fidelity Factor ETFs) employed in the All-in-One ETFs may be positioned favourably for the continuation of a broadening equity market, especially in the U.S. market. The main driving force of global equity returns over the past two years has been the outsized returns of U.S. mega-cap technology stocks, also often referred to as the “Magnificent 7.” For example, in 2023, they were responsible for 68.5% of the total return of the S&P 500 Index (in Canadian dollar terms), compared to only 48.2% in 2024. This number has been seen to trend lower as other areas of the market, such as telecommunications, banks and utilities, rallied in 2024, resulting in better overall market breadth.

Why is this important for the All-In-One ETFs? By definition, factor ETFs screen for stocks based on fundamental characteristics such as valuation, return on capital and earnings variability, among others. There is less consideration for market cap. For example, the U.S. equity components of the Fidelity All-In-One Equity ETF (ticker: FEQT) has a 16.6% weighting in the Magnificent 7, compared with 31.6% for the S&P 500 Index, as shown in Chart 9 (as at November 30, 2024). Given that the suite has approximately 50% of equity exposure to the U.S., a broadening scenario could potentially have a materially positive impact on total return for the suite in 2025.

What investors should keep in mind as 2025 unfolds

As we head into a new calendar year, the persistence of the AI trade, policy shifts and geopolitical concerns will likely be top of mind for investors. Many uncertainties will shape market sentiment and investment decisions.

For example, how will AI-driven innovation continue to disrupt industries? What's next in the central bank playbook? How long will geopolitical uncertainty persist, and what impacts will potential tariffs have on global trade and economic stability?

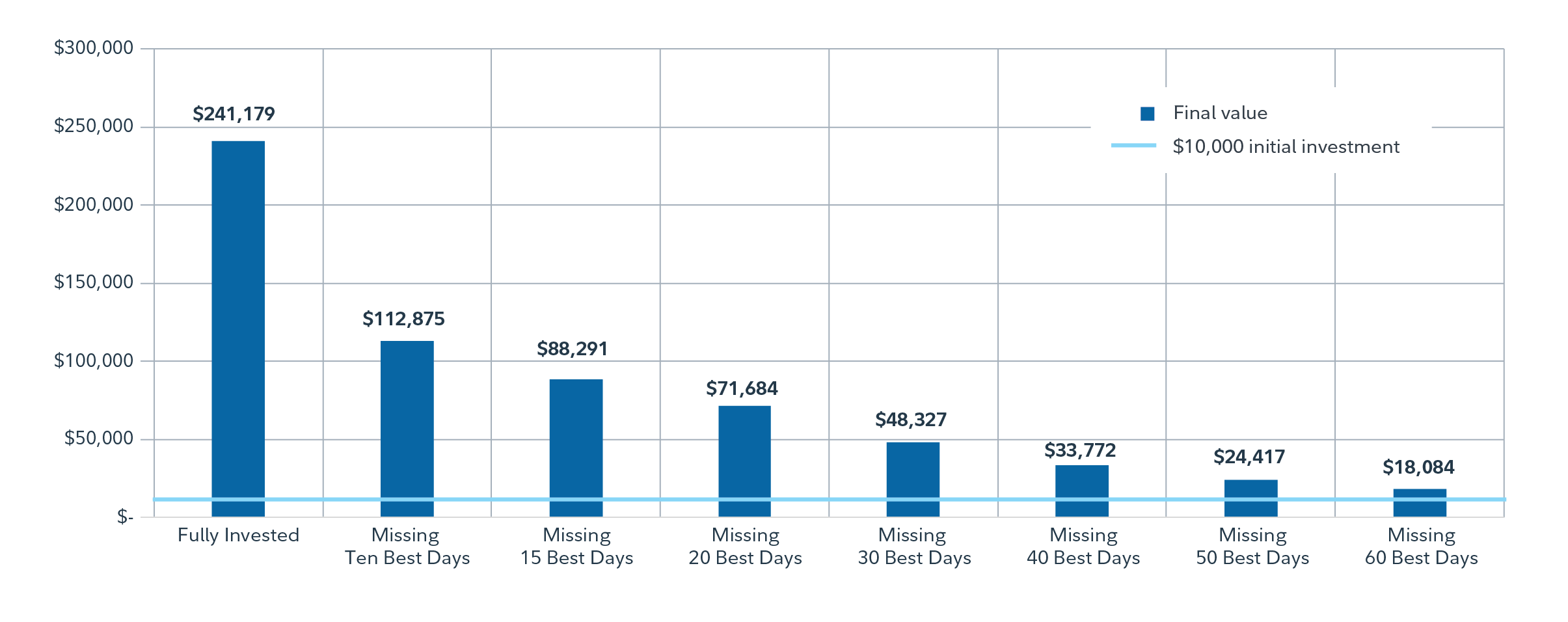

It remains to be seen how these questions will be answered in the coming year. However, these uncertainties underscore the importance of staying invested and maintaining a diversified portfolio to navigate market volatility effectively. A key reason for this approach is illustrated in Chart 10, which shows the significant impact of missing the market’s best days on long-term returns.

Missing just the ten, 15 or 20 best days can drastically reduce overall portfolio growth. This highlights why remaining invested through periods of uncertainty is critical to capturing the full benefits of market recovery and long-term wealth creation. Staying invested, maintaining diversification in your portfolio and working with a financial advisor can help manage short-term risks while pursuing long-term investment goals.

For more information, please visit Fidelity.ca or contact your Fidelity team.

Footnotes

1, 2, 3 The Investment Funds Institute of Canada.