Income investment strategies: Key approaches for investors

Income-focused investing involves seeking to generate a steady stream of cash flow from investments that can be used to supplement daily income requirements. Although it might sound challenging to execute such a plan, it’s mostly about understanding and making informed decisions. Investors have unique preferences, beliefs, requirements, and risk tolerances that guide them in their optimal portfolio allocation. For instance, aging investors may prioritize safety along with income generation, while other investors may welcome additional risks to achieve potential capital appreciation and income. It’s all about finding the right balance that aligns with your investment goals. For the income-focused investor, the diversity of available strategies underlines the vast potential and flexibility income-focused investing can offer.

Investing for cash flow

Investors can choose from Equity, Fixed Income and Balanced strategies to meet their income needs.

Equity-only income strategies may target securities with a higher dividend yield which may provide investors with a suitable level of cash flow consistently. Also, equity strategies can help grow capital in times of rising markets, allowing these strategies to be income producing and potentially capital appreciating. One of the benefits of dividend income is that in times of lower interest rates, dividends can help provide a higher level of cash flow over traditional bonds.

Dividend stocks are companies that pay out a portion of their profits as dividends to their investors. High-quality dividend-paying stocks offer not only the potential for capital appreciation but also provide a source of cash flow that could increase over time if the company continues to deliver. This combination of capital appreciation, income stability and potential growth of cash flow could help avoid the loss of purchasing power to which fixed income investors can be exposed.

One key thing to note about dividend paying stocks is that, as with the rest of the equity markets and asset classes, specific risk factors are involved.

- The number of dividends paid is not certain. Unlike fixed income securities, which can potentially generate regular cash flow, dividend-paying companies can increase or decrease their dividends depending on economic conditions. Also, global macro shocks that result in sharp downturns can force those companies to reduce or cut their dividends, resulting in loss of cash flow, stock price underperformance and loss of capital.

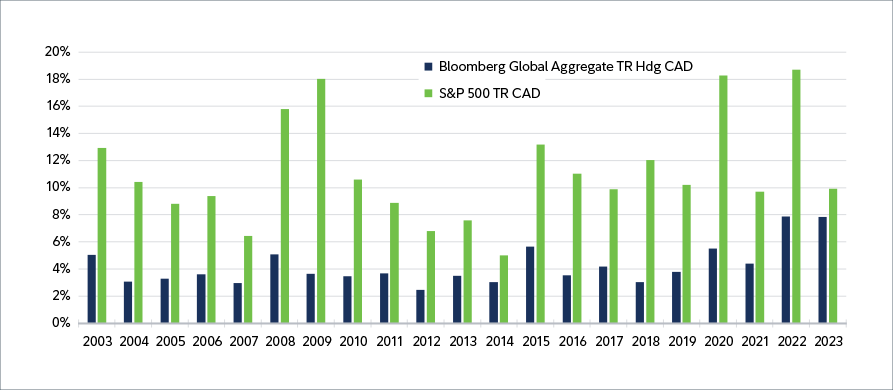

- Equities are at the greatest risk of loss of capital due to downturns in equity markets. Consider the best calendar year return for equity markets in the year 2013. The S&P 500 Index CAD delivered 41% vs 0.6% for the Bond market represented by the Bloomberg Global Agg Index CAD. Compared to the year 2008, Equity markets were down -21%, while the Bond market offered better capital protection, with the index down -12% (Chart1). Additionally, the volatility of equities also tends to be much higher than that of fixed income investments. Chart 2 shows that fixed income investments can be substantially less risky than equity investments over time. This reduced volatility may help preserve capital for investors.

The investment horizon for some investors may not allow for large shocks to their portfolios. In such cases, Bonds and Money Market instruments, which are much lower in risk than equities, may appear to be a better solution to their investment needs, providing income with a lower risk profile. However, while these lower-risk investments may help preserve capital, one downside is that they may not generate sufficient cash flow to meet investor’s needs. During periods of low interest rates, the yield on these instruments can be low, making a pure fixed income approach potentially not beneficial to the overall investment goals. Additionally, during times of high inflation purchasing power falls, and existing instruments may not offer competitive returns. Hence, it's vital for investors to decide the right balance between capital appreciation and volatility while balancing their income needs.

![The data in the chart is described in the text.]](/content/dam/fidelity/images/articles/charts/income-focused-investor-chart-1.png)

Fixed income vs. equities: Understanding the difference

- Fixed income can offer steady cash flows and a lower risk profile.

- It exhibits lower volatility compared with equity markets.

- It suits risk-averse investors who are unable to bear equity downturns due to, for example, a shorter investment time horizon.

- Fixed income generally exhibits smaller capital growth relative to equities.

- Fixed income is negatively affected during periods of high inflation, because of a loss of purchasing power.

- In periods of high market stress, downturns in all asset classes can occur, resulting in loss of capital.

A Balanced Approach

For exposure to the capital appreciating securities as well as an array of diverse income producing solutions, investors may opt for balanced portfolios which allocate to fixed income and equity securities. These portfolios offer access to a diversified mix of equity securities which have potential for capital appreciation and fixed income securities suitable for steady income needs. Also, the low correlation between the two asset classes in a low inflation environment could help reduce portfolio volatility relative to the overall market providing for a smoother investment journey.

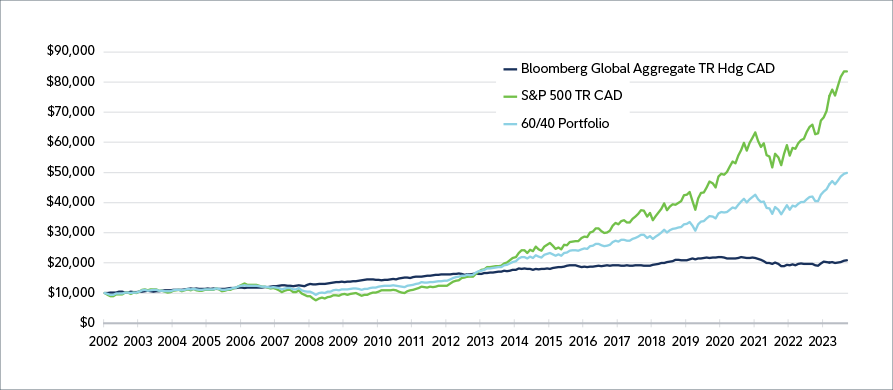

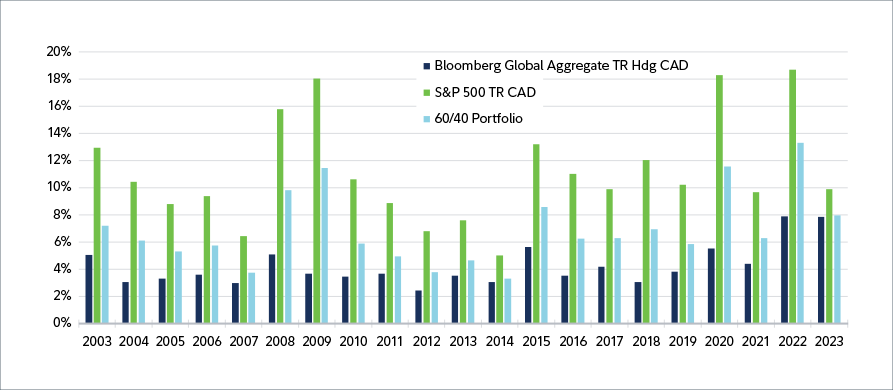

One way to access Balanced portfolios is through single ticket solutions offering strategic exposure to Fixed Income ETFs and Equity ETFs. These investment vehicles offer diversification and can provide investors with the tools needed to meet the cash flow needs of a risk-averse investor, while offering the potential for capital preservation and growth. Charts 3 and 4 illustrate the potential of a diverse asset mix to grow capital while exhibiting reduced portfolio volatility by creating a portfolio consisting of 60% S&P 500 CAD and 40% Bloomberg Global Aggregate Index CAD.

Consider the Options.

- The income-focused investor should consider as part of an overall portfolio diversified offerings across different asset classes and regions.

- Single-ticket solution funds provide exposure to equities and fixed income securities on a domestic or global scale, enhancing diversification benefits for the income-focused investor.

- Allocating only to fixed income securities may preserve capital in the long run, but does not provide the optimal portfolio structure, which relies on asset class diversification for a smoother investment journey. Nor does a fixed income-only portfolio protect an investor during inflationary periods and the associated loss of purchasing power.

- Equity-only exposure does not fully protect an investor from sharp market downturns.

- A sound investment strategy diversifies fixed income and equity allocations, providing income-{focused investors with multiple avenues to achieve their goals of cash flow generation, risk reduction and potential capital appreciation.

New enhanced cash flow-generating strategies

With advances in portfolio management, technology and market dynamics, new products have emerged that increase overall diversification and potentially reduce the risk profile of an investor’s portfolio.

Covered call Equity strategies are one such innovation, offering investors a new way to generate potential cash flow while also providing the potential for risk reduction. Covered call strategies invest in equities that have the potential not only for capital appreciation but also dividend income. They also aim to provide additional cash flow by writing call options on equities in the portfolio or an index representative of stocks in the portfolio. The premiums received from writing these call options are distributed to investors, potentially providing a larger yield than a traditional dividend investing strategy.

Another benefit of the covered call strategy, over equity and fixed income strategies, is that they are potentially much more tax efficient; the cash flow generated from the option premiums is taxed as capital gains, rather than as income.

Balancing risk and reward: Investment strategies for income and growth

There is no such thing as a free lunch. Risk is inherent in investing, but it can be managed and reduced. Every investment strategy has a different risk and reward profile, and it has been demonstrated that combining different strategies across asset classes and regions increases diversification, helping investors reduce their overall risk profile and enhance their potential reward. Cash, money market and fixed income investments have steady cash flow and lower risk metrics but offer small potential growth. Equity strategies that target high dividend paying stocks offer higher yields and capital appreciation, but also the risk of increased volatility and potential short-term loss of capital in market downturns. Covered call strategies have potential to offer much higher yields and modest capital growth with some downside protection due to cash flow generation from option writing activities, but they could be costly for investors and complicated to manage – and in a sharply rising market, their returns are capped as buyers of the options are likely to exercise their rights.

The right balance and investment mix is critical for the income-focused investor. At Fidelity, our years of service, dedicated research and professional asset management capabilities put your investments in the right hands, with the goal of bringing you closer to achieving your investment goals.