Trade wars and market uncertainty: What investors need to know

Summary

The year has begun with a more volatile start for markets, with broad-based uncertainty fuelled by a wave of potential policy changes in several key areas being discussed by the new U.S. administration. In particular, substantial changes to trade policy have sparked concerns among investors, with U.S. President Donald Trump proposing a series of significant tariffs. The administration has framed these tariffs as a strategy to pressure foreign nations on trade, immigration and industrial policy, while also aiming to strengthen U.S. manufacturing and high-tech industries.

Overall, tariff announcements remain a dynamic policy focus for the Trump administration and have had a pronounced impact on markets. It remains to be seen what the lasting effects will be, but markets have started the year with volatility, reflecting investor concerns about potential trade conflicts and economic deceleration. The decline has generally been widespread, adversely affecting sectors with elevated valuations, such as information technology and consumer discretionary. The enduring effects of these tariffs on the global economy and stock markets remain uncertain and will largely depend on the duration of the trade measures and the responses from affected trading partners. Prolonged trade disputes could lead to sustained market volatility, reduced business investment and a slowdown in economic growth.

Potential economic implications may include the following.

Inflationary pressures: The impact on input costs is likely to be transferred to consumers, leading to a potential increase in prices for a range of goods.

Supply chain disruptions: The tariffs may disrupt established supply chains, which could result in production delays and increased operational costs for businesses.

Trade retaliation: Affected nations are likely to implement reciprocal tariffs on U.S. goods, which will affect American exports and worsen trade tensions. Further trade retaliation may exacerbate economic impacts.

Monetary policy considerations: The U.S. Federal Reserve (the Fed) faces heightened challenges in balancing efforts to control inflation with the need to support economic growth. Persistent inflationary trends, which can be adversely affected by tariffs, may compel the Fed to maintain elevated interest rates, thereby increasing borrowing costs for consumers and businesses.

While the recent uptick in volatility may seem unsettling, it is important to remember that short-term fluctuations are a part of market cycles over the long term.

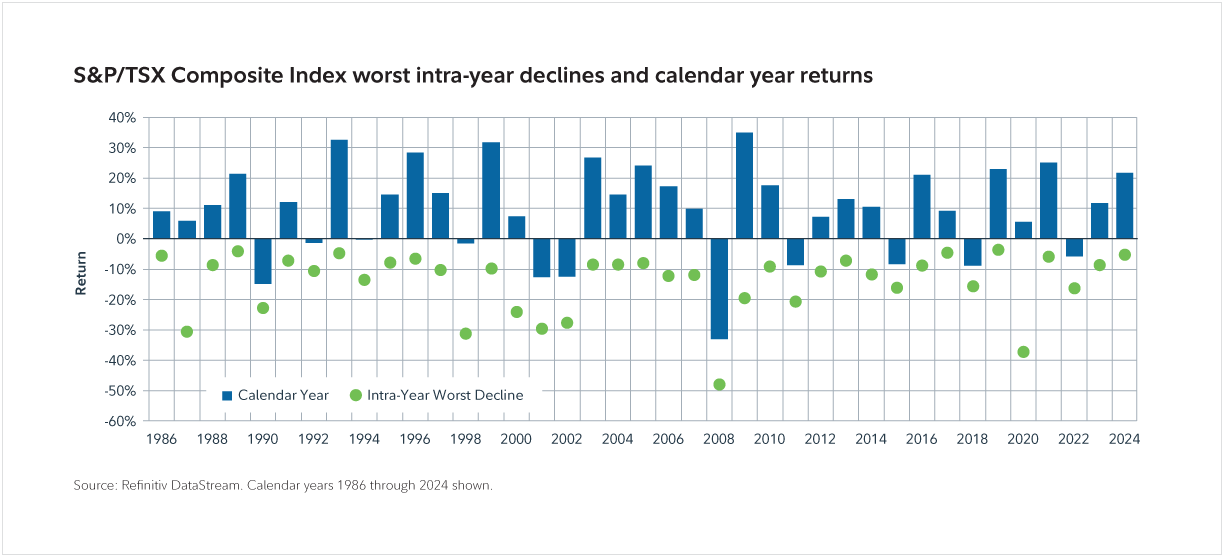

As shown in the chart, although every year since 1986 has seen an intra-year drawdown, approximately 70% of the calendar years still ended with a positive absolute return. Notably, this also includes years with a sizable drawdown: in 2009, there was a 35.1% return despite a -19.6% intra-year drop, and in 2020 there was a 5.6% return despite a -37.2% decline. Even in years with negative market returns, the losses shown were less severe than the drawdowns, and the intra-year volatility did not necessarily translate into a significant long-term trend in the following years.

Andrew Marchese, Chief Investment Officer and Portfolio Manager, Fidelity Canadian Disciplined Equity® Fund

The announcement of reciprocal tariffs by the U.S. administration has added another layer of uncertainty to global markets. These measures mark a significant shift in the global trade landscape – one that investors have not encountered in decades. As we navigate this unfamiliar territory, the implications span inflation, growth and, ultimately, portfolio strategy.

According to CIO and Portfolio Manager Andrew Marchese, the immediate macroeconomic concern is inflation. Tariffs function as a tax on imports, raising input costs and exerting upward pressure on consumer prices, not just in the U.S., but globally. While the full impact will take time to materialize, Andrew expects inflationary pressures to persist over the short term, especially in the sectors most exposed to trade flows. Employment and capital expenditures are also likely to be affected, with companies reassessing hiring and investment plans in the face of higher costs and demand uncertainty.

Despite headline volatility, credit markets remain relatively stable, with corporate bond spreads showing few signs of distress. This suggests that while uncertainty is high, systemic stress is not yet apparent. However, from a microeconomic standpoint, Andrew expects many companies to delay key capital allocation decisions until there is greater policy clarity. Forward-looking visibility remains limited, and businesses are navigating this shift cautiously.

Drawing from historical context, Andrew notes that while tariffs may drive short-term inflation, they are typically disinflationary over time and tend to weigh on global growth. The current environment raises the risk of stagflation – in which rising costs collide with slowing economic momentum – posing challenges for both policy makers and investors.

In managing portfolios through this period, Andrew emphasizes the importance of discipline and a long-term lens. Rather than make reactive changes, Fidelity’s investment team has used the early part of the year to reassess valuations and selectively reposition portfolios. The focus has been on owning high-quality businesses with strong balance sheets, stable cash flows and the ability to weather near-term volatility.

Capital has been reallocated toward companies with more resilient earnings profiles and away from areas where valuation or earnings expectations appear overly optimistic. Importantly, Andrew and the team continue to engage closely with company management teams to better understand both near-term challenges and long-term strategic plans. This bottom- up research effort is central to Fidelity’s approach and is particularly valuable in a period when macro developments can quickly overwhelm market sentiment.

While the current environment lacks a clear historical playbook, Andrew believes Fidelity’s depth of research and commitment to fundamental investing provide a strong foundation for navigating the uncertainty ahead. Staying patient, remaining diversified and focusing on long-term goals will be key to delivering better outcomes for investors through this period of elevated volatility.

David Wolf and David Tulk, Portfolio Managers, Global Asset Allocation Team

In recent periods, there have been dramatic changes in the U.S. policy environment. Given the escalation of uncertainties, markets have likewise become irritable. Tariffs will make imported goods more expensive for Americans, and retaliatory measures will make imported goods more expensive for the country retaliating. In the case of Canada, the damage to Canada’s economy is expected to outweigh the impact on the U.S. economy. About three-quarters of total Canadian exports, accounting for 20% of the Canadian GDP, are sent to the U.S.* This is a large and significant share, and a critical driver of the Canadian economy.

It is difficult to assess the ultimate impact these measures could have on the Canadian economy with any level of certainty at this juncture. That said, the most helpful analysis comes from the January 2025 Monetary Policy Report issued by the Bank of Canada (BoC). This report discusses the effect a 25% tariff would have on Canada, using several of the BoC’s proprietary economic models to simulate the impact. In summary, the BoC found that a sustained 25% tariff on Canadian exports will result in a significant negative shock to growth, higher inflation and a depreciation of the Canadian dollar.

The Global Asset Allocation team believes that these tariffs will likely push Canada into a recession. The risk of a recession in Canada was already elevated prior to the tariff announcement; Canada was already in a weaker state due to anemic growth since the start of 2023. Canada has been and continues to be constrained by high household debt accumulated over the years. Furthermore, with interest rates still much higher than in the past decade, households are having to refinance their mortgages at higher interest rates, further straining household budgets, with consumers being forced to direct more of their discretionary spending toward debt repayment, rather than contributing to the economy. This tariff event is just another exposure to the downside in what was already a weaker economic activity environment for Canada, meaning the risk of a recession in Canada has now increased from what was already an elevated level.

A considerable amount of uncertainty remains about the potential for tariffs, but the team is following the issue closely. Over the recent periods, the managers have reduced their U.S. equity exposure and have allocated more toward defensive assets, reducing their overall risk posture in the market. They have added to their existing gold exposure through an exchange-traded fund and Treasury Inflation-Protected Securities. In addition, the managers continue to hold less exposure to the Canadian dollar than the U.S. dollar, to help build downside protection into their funds in the event of risk-off events. More broadly, the managers emphasize diversification in the structure of their funds. Their research- based framework is critical in informing the positioning so that the funds can be resilient to a wide range of shocks driven by these sorts of events.

Will Danoff, Portfolio Manager, Fidelity Insights Class®

In light of recent market volatility driven by tariff-related headlines, Will Danoff emphasizes that while the market reacts to daily news cycles, the portfolio remains focused on long-term fundamentals, rather than news-driven market volatility. Through his tenure, Will has navigated many periods of sharp market volatility, often marked by periods of increased uncertainty. He emphasizes his core belief that stock prices follow earnings, which remains a constant and may create future opportunities as clarity returns.

Will acknowledges the potential uncertainties regarding policy outcomes but highlights that he doesn’t attempt to predict the direction of tariffs or broader political developments. Instead, the focus is on understanding how businesses are positioned to weather these disruptions – and in many cases, emerge stronger. The portfolio strategy remains disciplined as Will re-examines his investment theses, engages with company management and leans on analyst insights to identify compelling long-term opportunities.

Will believes many leading technology and consumer companies continue to demonstrate strong competitive advantages and resilient long-term earnings potential. These companies, largely driven by intellectual property and services, may be less exposed to direct tariff-related uncertainty than traditional manufacturing sectors, but may face indiscriminate selling due to elevated market uncertainty. Will notes that valuations across select holdings have become increasingly attractive, particularly after recent pullbacks. The recent volatility among the best-of-breed market leaders has brought valuations into historically attractive ranges and could present opportunities for long-term investors. He notes that while short-term sentiment may fluctuate, the artificial intelligence buildout remains a multi-year secular growth story.

As in similar periods in the past, Will and his team aim to actively leverage the current market to upgrade the portfolio, selectively adding to high-conviction names on news-driven weakness. Will reiterates that while market conditions remain fluid, history shows that periods of volatility often create the most attractive entry points for patient investors. Overall, the portfolio remains well positioned, anchored in durable, competitively advantaged best-of-breed companies. While near- term uncertainty may persist, the team remains optimistic about the long-term potential embedded in these investments, without relying on predictions about tariffs or macroeconomic outcomes.

David Way, Portfolio Manager, Fidelity Long/Short Alternative Fund

Portfolio manager David Way notes that the current market backdrop presents a number of complex challenges, with the imposition of tariffs by the U.S. giving rise to a period of uncertainty, which could affect business decision-making, consumer behaviour and export dynamics in Canada. However, David emphasizes that this presents opportunities for his fund’s unique mandate, which allows him to construct a portfolio comprising stocks poised to withstand the negative impacts of the tariffs while benefiting from stronger medium-term prospects. Namely, David is remaining focused on identifying long opportunities in resilient businesses that he expects to benefit from improving industry conditions or company-specific factors, across various sectors.

In addition, David is balancing the long side of his fund with a robust short portfolio targeting companies that face underappreciated challenges in an ever-changing economic and competitive environment. Specifically, he is continuing to search in areas that stand to face slowing earnings growth, aiming to uncover companies likely to face adverse business effects due to the tariffs and the subsequent reordering of global trade routes.

The manager underscores the importance of preparation in Fidelity’s investment process; taking a proactive approach in leveraging Fidelity’s deep research platform is instrumental to identifying companies that can potentially be more insulated from potential tariff impacts and those more exposed to such impacts. David has been proactive in engaging with companies to assess their direct and indirect exposure to these headwinds, while closely analyzing supply chains and quantifying potential tariff impacts, aiming to fortify his portfolio ahead of the headlines.

Looking ahead, David notes there could be a significant repricing of risk across many parts of the market that might present attractive opportunities for a long/short portfolio. While near-term uncertainty may persist, David is remaining focused on identifying dislocations amid companies that he believes have substantial upside potential over the coming years, and strategically positioning his portfolio to capitalize on both long and short opportunities as they emerge.

Sri Tella and Lee Ormiston, Portfolio Managers, Canadian Fixed Income

Despite a positive backdrop at the end of 2024, the outlook has shifted materially. As Tiff Macklem’s remarked on February 21, “a structural change is upon us. Increased trade friction with the United States is a new reality.” And from the BoC statement on March 12: “The pervasive uncertainty created by continuously changing U.S. tariff threats is restraining consumers’ spending intentions and businesses’ plans to hire and invest.”

The markets are pricing in growth that is below trend, a terminal rate in this cutting cycle below 2.25%, and two- to three- year inflation above target. While the equity markets are pricing in a negative effect on income statements, credit markets, by comparison, have remained relatively stable, because most Canadian balance sheets exited the pandemic in a strong position. However, we may see pockets of idiosyncratic stress.

It is important to note that the BoC has the ability to reduce interest rates significantly. Fiscal deficits can be expanded to deliver appropriate and targeted support. But even if the size and duration of tariffs were known, outcomes would be difficult to predict. As a result, the managers’ current positioning reflects the caution needed for an uncertain outlook.

Sam Polyak, Portfolio Manager, Fidelity Emerging Markets Fund

With escalated U.S. tariffs on emerging market goods, investors continue to assess the broader implications for global markets. While many expect these policies to weigh on emerging market economies, Sam takes a more nuanced view, highlighting the potential opportunities arising from shifting capital flows, government responses and long-term structural trends.

A key consideration is the impact of tariffs within the broader macroeconomic environment. The U.S. government’s fiscal policies – including sustained deficit spending – are pushing the national debt higher, which, over time, could ultimately weaken the U.S. dollar. Sam believes this could provide a tailwind for emerging markets, particularly in regions such as Latin America, Eastern Europe, South Africa and Southeast Asia, as capital seeks higher-growth opportunities abroad. In his view, emerging market government balance sheets are in much better shape than those of their developed market counterparts, which should help support growth and earnings for companies not directly tied to the U.S.

There is also a growing divergence in the ability of U.S. companies to pass on costs. Sam notes that many U.S. firms may struggle to raise prices in a weaker demand environment, putting pressure on volumes and corporate earnings. While some emerging market companies may feel the pinch as well, Sam believes the majority are not directly exposed to these pressures. Over time, this earnings growth differential between emerging and developing markets could narrow – or even reverse – providing a basis for emerging market outperformance as current tariff-related policies play out.

In China, Sam expects policy makers to counterbalance tariff-related pressures with targeted stimulus, supporting key sectors and stabilizing growth. Beyond that immediate policy response, he also expects China’s consumer economy will be a long-term driver of investment potential. Despite China’s role as a global economic powerhouse, its domestic consumption remains underdeveloped relative to western markets, providing a significant runway for expansion as the middle class grows and spending power increases.

Valuations further reinforce the case for emerging markets. Even after the implementation of tariffs, emerging market equities remain deeply discounted relative to U.S. stocks and are near historical lows. Sam believes this gap is unlikely to persist indefinitely, particularly as investors seek diversification amid evolving macroeconomic conditions. While tariffs introduce uncertainty, they are just one piece of a broader investment landscape. Sam sees opportunities emerging as governments and markets adjust, reinforcing the importance of a selective, long-term approach to investing in emerging markets.

Salim Hart, Portfolio Manager, Fidelity Global Micro-Cap Fund

Salim notes that with geopolitical risks and economic turbulence shaping the early months of 2025, the top large-cap names that made headlines last year are now facing notable declines, emphasizing the importance of regional and market-cap diversification.

Although micro-cap stocks are often perceived as riskier due to their smaller size and limited market visibility, Salim explains that they may offer stability in the midst of the global trade upheaval. Micro caps tend to have more regionally focused revenue streams and exposure to their own local markets, making them less vulnerable to tariffs. Top-ten holding Katitas, for example, is uniquely positioned for growth: by purchasing, renovating and distributing aging homes, it capitalizes on Japan’s long-standing practice of regularly remodelling properties to align with modern trends.

From a geographical standpoint, the manager is currently taking advantage of regional market dislocations due to investor fearfulness that has led certain companies to trade at attractive prices. In France, for instance, many companies with a long-term track record faced substantial turbulence last summer during the French elections, offering Salim a number of strategically timed, discounted entry points to acquire potentially strong compounders. In the fall, a brief but violent yen carry unwinding provided an attractive buying opportunity in Japan. This year, we have seen the widest quarterly dispersion of returns between several geographies going back multiple decades, offering a chance to continue to reposition the portfolio in areas of value and fear, while still adhering to a quality discipline and superior growth opportunity.

Private equity firms continue to show significant interest in select high-quality micro caps, and Fidelity Global Micro- Cap Fund, the only micro-cap mutual fund available to retail investors in Canada, is poised to benefit from the U.S. administration’s deregulation and corporation-friendly attitude; the Fund has already seen 14 buyouts of its holdings since the Fund’s inception on May 22, 2024.

Darren Lekkerkerker, Portfolio Manager, Fidelity North American Equity Class

In light of market uncertainty and tariffs imposed by the U.S. on international markets, portfolio manager Darren Lekkerkerker is exercising caution in the near term, and continues to monitor the macroeconomic environment closely. Darren notes that the negative impact of tariffs will be widespread across sectors, but particularly pressuring companies in the consumer and industrials sectors that rely on imports and exports and lack the pricing power to adjust to the tariffs. Companies that could be hurt by weaker economic growth also face heightened risk. To prepare for the implementation of tariffs, Darren has examined possible outcomes, analyzed which sectors may be negatively affected and, on the flipside, identified opportunities that could stand to benefit. Through this process, he has met with numerous CEOs and management teams over the past few months to understand the potential impact on their businesses.

Overall, Darren continues to focus on high-quality companies, characterized by stable businesses, resilient demand, wide profit margins and robust balance sheets. Since the beginning of the year, he has reduced exposure to companies in the consumer discretionary sector that produce goods that would be directly affected by tariffs, and to cyclical companies that can be affected by a weaker macro environment, such as banks and capital markets firms. He has found opportunities to deploy capital to high-quality defensive companies in insurance brokerage and consumer staples.

Additionally, he has found opportunities in communications services companies, given a mix of lower stock prices and strong fundamentals.

Morgen Peck and Sam Chamovitz, Portfolio Managers, Fidelity Global Intrinsic Value Class

The recent market fluctuations have been unsettling, and a lot is not yet known, such as the duration of tariffs and the extent of responses from various countries, among other things. In this fluid environment, the managers emphasize the importance of preparation, with the help of Fidelity’s talented research team, and patience, in seeking resilient and adaptive companies led by highly competent management teams who can face a wide range of outcomes. The managers believe Fidelity Global Intrinsic Value Class is well positioned to navigate prolonged volatility, and they will continue to aim to consistently offer strong risk-adjusted returns with lower volatility levels. Avoiding fast-changing industries, the managers’ investment framework prioritizes companies that offer stability, high-quality free cash flow and reinvestment growth opportunities over the next five to ten years. Morgen and Sam have increased their portfolio’s exposure to cyclical areas that appeared underappreciated by the market, letting valuations be their compass, because they believe undervalued stocks provide a safety margin.

Don Newman, Portfolio Manager, Fidelity Dividend Fund

Don notes that it is too early to tell how tariffs will affect companies. He acknowledges the uncertainty regarding tariffs, and the challenges they present could be disruptive for corporate decision-making, because prolonged tariff uncertainty could stall capital expenditure plans. The manager notes that markets do not like uncertainty; accordingly, there could be some near-term volatility in the market. Given the market’s aversion to uncertainty, Don has been adjusting his portfolios toward to what he views as companies with higher visibility, specifically, companies with more stable earnings outlooks and limited exposure to tariff-related disruptions. He has also been starting to search for stocks that may have been unduly affected by perceived tariff and economic impacts, aiming to invest in high-quality securities that may offer significant long-term upside potential.

Don notes that high-quality companies with strong fundamentals and a track record of maintaining and growing dividends over time may be well positioned for this market environment. Finally, he highlights that active management can play a crucial role in periods of heightened uncertainty. Through leveraging fundamental research, backed by Fidelity’s extensive resources, managers may be better able to navigate market volatility, by uncovering mispriced opportunities and resilient businesses.

Patrice Quirion, Portfolio Manager, Fidelity International Concentrated Equity Fund and Fidelity Global Concentrated Equity Fund

Through 2024, markets were propelled upwards by a belief in U.S. exceptionalism and the promise of artificial intelligence. This sentiment contributed to a global divergence between the U.S. and international markets. Broadly lower valuations and strong growth potential among opportunities in international markets prompted portfolio manager Patrice Quirion to shift his portfolios away from the U.S. Despite the market consensus that the new U.S. administration’s policies would be positive for the U.S. and largely negative for international markets, Patrice was cautious about the sustainability of the U.S. market at its all-time highs. Tariff uncertainty in the beginning months of the year threatened the strength of the U.S. market, adding to volatility and shifts in market leadership. These changes were largely negative for the U.S., causing a rebalancing in markets from a regional perspective.

Patrice notes that new tariffs imposed by the U.S. on international markets will have a sweepingly negative effect across the board. He observes that the post-COVID boom in the U.S. led consumers to re-leverage, while consumer confidence in international markets has remained low.

Patrice continues to assess the impact of tariffs on his portfolios, but he is also using the current environment to evaluate new potential areas of opportunity that may be mispriced by the market. The manager’s contrarian investment style targets predictable, durable and growing businesses that can compound over time and that may be currently undervalued. He is particularly excited about opportunities in the Chinese consumer discretionary space, where domestic businesses offering quality products at lower prices are beginning to take market share from leading multinationals.

Overall, Patrice emphasizes the importance of portfolio diversification and adopting a bottom-up investment approach, rather than adding to holdings based on a sector’s attributes from a top-down perspective.

Aruna Karunathilake and Sam Morse, Portfolio Managers, Fidelity Europe Fund

Aruna Karunathilake and Sam Morse note that while there may still be room for negotiation, elevated tariffs and persistent uncertainty have heightened the risk of recession in Europe. They acknowledge that the potential economic impact could be severe. However, it is encouraging to see Europe responding with fiscal stimulus, and they believe the European Central Bank still has the scope to cut interest rates, supported by inflation remaining near its 2% target.

The portfolio profile is unlikely to be altered in response to tariff developments, given the frequent changes in the scope and targets of U.S. trade policies and the Fund’s limited exposure to major European exporters to the U.S. The sectors seeing the most impact are expected to be autos, spirits and luxury goods. The Fund has no exposure to autos, while exposure to spirits is limited to a U.K.-based beverage company. In the luxury segment, the Fund’s exposure is focused on high-end names with strong pricing power and relatively inelastic demand.

From an investment standpoint, European companies remain appealing. They are global players, generating less than one-third of their profits within the European region itself. It is important to be selective in identifying companies that demonstrate resilience in the face of adversity. The portfolio managers are confident that their investment approach, with its focus on bottom-up stock picking, enables them to capture these attractive opportunities and position their portfolios effectively for a potentially more challenging environment.

Nitin Bajaj and Alice Li, Portfolio Managers, Fidelity China Fund

The portfolio managers continue to focus on finding opportunities in unfavoured businesses in China that are trading at significant discounts to their long-term prospects, and where the market is underestimating the resilience of well-managed companies with strong balance sheets and considerable market share supported by healthy business models.

The largest opportunity set for the Fund is in durable consumer businesses in both discretionary and staples where the wider market is too narrowly focused on consumer confidence and near-term consumption pressures, and is overlooking longer-term franchise value. At the other extreme is the Fund’s minimal exposure to the Chinese information technology sector, where there has been a lot of hype about perceived beneficiaries of AI and interest in Chinese AI firms prompted by the success of DeepSeek. The managers are well aware of this sentiment-driven momentum, which was also evident in a recent, narrowly focused rally. However, this momentum-led rally offers very little margin of safety for long-term investors at this stage, which poses a risk that the managers do not want to assume for the Fund.

The managers seldom comment on macroeconomics, but have noted on several occasions that China stands out in terms of its strength of human talent and the technological expertise it offers – an edge that is less likely to be dented by geopolitics. The economies of scale in Chinese manufacturing give it the capability to explore several global markets as customers, and in some areas, the quality of Chinese output cannot be found elsewhere. The onset of tariffs will also have a lower incremental impact on domestic China, where the Fund’s search for opportunities is focused.

Hide Footnotes

Written as at April 2, 2025.

* Source: Statistics Canada.