What are the average incomes in Canada?

Have you ever wondered how your income compares to that of your fellow Canadians? One way to check is to search for the average income in Canada, but this approach probably won't give you the full picture. As you might imagine, average income will vary across the country and will be influenced by factors such as your job, age, and gender. So, if you're looking for a better understanding of how your income compares, here are some of the key figures you’ll need if you want to benchmark your income and earning potential.

Incomes aren’t always what they seem.

If you were to use the average income as your yardstick, you’d learn that those 16 and above earned an average of $54,000 in 2021, which is the most recent official data available from Statistics Canada. That’s up about 6% since 2017.1 To put that into perspective, that would be equal to a full-time employee making about $26 an hour, or about 40% higher than what you’d earn if you made minimum wage.

|

Average income (2021) |

Five-year change |

Canada |

$54,000 |

6% |

Atlantic provinces |

$48,000 |

6% |

Prairie provinces |

$56,000 |

-1% |

Manitoba |

$49,300 |

1% |

Saskatchewan |

$52,100 |

-2% |

Alberta |

$59,000 |

-2% |

Quebec |

$51,200 |

11% |

Ontario |

$55,500 |

7% |

British Columbia |

$54,700 |

9% |

Source: “Income of individuals by age group, sex and income source, Canada, provinces and selected census metropolitan areas,” Statistics Canada. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1110023901

The story changes if you narrow down the geography. What might be seen as a more than comfortable salary in some parts of the country might be below average in another when you factor in the cost of living. If you’re living in one of Canada’s largest metropolitan areas, earning “average” would mean making anywhere from $52,300 in Quebec City to $61,900 in Ottawa. Meanwhile, average income in Toronto has climbed by 7% over the past five years. That’s welcome news, given the cost of living in Canada’s largest city, but at $56,700 a year, incomes in Toronto are only $3,700 above than the national average.

Major cities |

Average income (2021) |

Five-year change |

Ottawa-Gatineau, Ontario/Quebec |

$61,900 |

6% |

Calgary |

$61,400 |

0% |

Edmonton |

$59,700 |

-1% |

Toronto |

$56,700 |

7% |

Vancouver |

$55,300 |

8% |

Montreal, Quebec |

$53,300 |

13% |

Quebec City, Quebec |

$52,300 |

5% |

Winnipeg, Manitoba |

$50,700 |

3% |

Source: “Income of individuals by age group, sex and income source, Canada, provinces and selected census metropolitan areas,” Statistics Canada. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1110023901

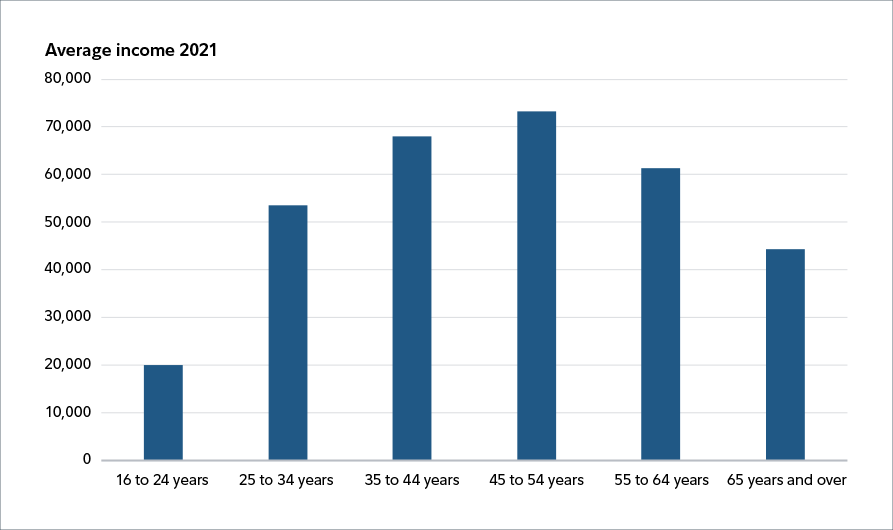

Average income by age in Canada

Still, if some of those figures seem low, you’re right. The national average is being pulled down by the almost four million Canadians between the ages of 16 and 24. As you might guess, that slice of the population usually earns less than those older than them, given many of them are just starting out. Collectively, this cohort makes an average of $20,000 a year, compared with Canadians between the ages of 45 and 54, who earn an annual average of $78,000.2

Source: “Income of individuals by age group, sex and income source, Canada, provinces and selected census metropolitan areas,” Statistics Canada. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1110023901

What is the average income per family in Canada?

Because average income value can be distorted by having a small number of extremely high-income earners or a high number of very low earners, statisticians tend to prefer to look at the median, which is the midpoint between high-income earning and low-income earning population. According to Statistics Canada, the median household income in 2020, based in the latest official data available, was $84,000, up 10.5% since 2015.3

Highest-paying industries in Canada in 2024

There’s a reason salaries in Edmonton are so high relative to the rest of the country (or even other communities within Alberta): there are a disproportionate number of people working in the resources sector, with high levels of employment for mining, oil and gas extraction support workers, who earn an average of $122,200 a year. The top 15 highest-paying industries in Canada are all earning more than $45 an hour.

Electric power generation, transmission and distribution |

$134,451.20 |

Rail transportation |

$125,424.00 |

Support activities for mining and oil and gas extraction |

$122,200.00 |

Computing infrastructure providers, data processing, web hosting and related services |

$115,918.40 |

Scientific research and development services |

$109,636.80 |

Local, municipal and regional public administration |

$107,952.00 |

Heavy and civil engineering construction |

$106,121.60 |

Education special 11 |

$106,017.60 |

Computer systems design and related services |

$105,248.00 |

Securities, commodity contracts, and other financial investment and related activities |

$102,606.40 |

Lessors of non-financial intangible assets (except copyrighted works) |

$101,712.00 |

Architectural, engineering and related services |

$100,110.40 |

Management, scientific and technical consulting services |

$ 97,385.60 |

Legal services |

$ 93,787.20 |

Source: “Average hourly earnings (including overtime) for salaried employees, by industry, annual,” Statistics Canada. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1410021001

Ways to improve your income

If you want to know where your income stands, it’s important to get as granular as possible, looking at the salaries in your area and industry. If your income doesn’t allow you to afford the lifestyle you want, you have options.

A good place to start is to focus on what you know. There’s no harm in trying to negotiate a salary increase to ensure you’re appropriately compensated for your hard work. But don’t stop there. While you’re having that conversation, ask for guidance on the skills and experience you’ll need to earn yourself a promotion.

To increase your odds of raising your earnings potential, it could benefit you to look for a new role. Focusing your search on some of the industries above could be a good place to start, especially if your skills are transferable to another sector.

Just remember, your salary isn’t the only income stream at your disposal. Investing can be another way to grow your money – and you don’t need to take on a lot of risk. Using passive income strategies that make money with little or no daily intervention on your part, with a portfolio of dividend stocks or fixed income investments, can be a lower-risk way to invest while still generating additional income. The longer you can invest – and reinvest some of that passive income – the more time your returns have to compound.

A nation of opportunity

Canada is one of the top 25 countries in the world in terms of income.4 Given the diversity of the country’s employment opportunities and the training available, there are always ways to advance your career and improve your earnings potential. As your income grows, take the opportunity to grow how much you’re saving to reach your goals even faster.

Looking to make the most of your money in 2024? Get the latest investing tips straight to your inbox by signing up for the Upside below: